Tesla vs Hyundai Ioniq 6: Which Electric Car Wins in Real-World Testing?

Table of Contents

- Introduction: The Electric Sedan Showdown

- Real-World Range Testing and Efficiency

- Charging Speed and Infrastructure Access

- Performance and Driving Dynamics

- Interior Quality, Technology, and Comfort

- Safety Features and Crash Test Results

- Total Ownership Costs and Value Analysis

- Winter Performance and Extreme Weather Testing

- Conclusion: Which Electric Car Wins?

- Frequently Asked Questions

Introduction: The Electric Sedan Showdown

The morning sun barely crested the horizon as Sarah pulled into the testing facility parking lot, her excitement palpable despite the early hour. Today marked the beginning of a comprehensive six-month evaluation that would finally answer the question consuming electric vehicle enthusiasts across the country: which electric sedan truly delivers superior real-world performance, the Tesla Model 3 or the Hyundai Ioniq 6? As a automotive journalist with fifteen years of experience testing vehicles across every conceivable condition, Sarah had witnessed the evolution of electric vehicles from niche curiosities to mainstream transportation solutions. Yet this comparison felt different, more consequential, because these two vehicles represented fundamentally different philosophies about what electric cars should be. Tesla, the American tech company that had single-handedly forced the automotive industry to take electrification seriously, faced off against Hyundai, the Korean manufacturing giant that had quietly perfected the art of building reliable, efficient vehicles while traditional automakers fumbled their electric transitions. The stakes extended far beyond simple brand loyalty or regional pride. Tens of thousands of consumers stood poised to make purchasing decisions that would define their transportation for the next decade, and they deserved accurate, unbiased information based on rigorous testing rather than marketing claims or internet speculation.

The electric vehicle market transformation has accelerated dramatically through 2025 and into 2026, with battery-electric vehicles now accounting for nearly fifteen percent of new vehicle sales in the United States according to recent automotive industry reports. This remarkable growth reflects improving technology, expanding charging infrastructure, increasing model availability, and evolving consumer attitudes toward electric propulsion. The Environmental Protection Agency has established comprehensive fuel economy testing protocols that provide standardized measurements for comparing electric vehicle efficiency across different models and manufacturers. These EPA fuel economy testing procedures simulate various driving conditions including city traffic, highway cruising, and climate control usage to generate the MPGe ratings displayed on vehicle window stickers. However, independent testing consistently reveals significant gaps between EPA estimates and real-world results, particularly when vehicles encounter extreme temperatures, aggressive driving, or extended highway speeds. Understanding these discrepancies proves critical for consumers evaluating electric vehicles based on their specific usage patterns rather than optimistic manufacturer claims. The testing methodology employed for this comparison incorporated elements from EPA standards while adding real-world scenarios that everyday drivers actually encounter, creating a comprehensive picture of how these vehicles perform beyond controlled laboratory conditions.

Although the following video was published two years ago, we have added important new information to this article to keep up with the developments expected in 2026. This is information you may not have discovered yet. :

Tesla has dominated the electric vehicle conversation since introducing the Model S in 2012, fundamentally reshaping consumer expectations about what electric cars could achieve in terms of range, performance, and technology integration. The Model 3, launched in 2017, brought Tesla’s vision to more affordable price points while maintaining the company’s focus on acceleration, minimalist interior design, and over-the-air software updates that continuously improve vehicle capabilities. By early 2026, Tesla had delivered well over two million Model 3 vehicles globally, making it the best-selling electric car in history and establishing the benchmark against which all competitors are measured. The company’s vertical integration strategy, including battery production, software development, and charging infrastructure, creates advantages that traditional automakers struggle to replicate. Tesla’s Supercharger network, with over fifty thousand connectors across North America, Europe, and Asia, remains the most reliable and convenient charging solution available to electric vehicle owners. The company’s commitment to rapid iteration means 2026 Model 3 vehicles incorporate numerous improvements over earlier versions, including heat pumps for cold-weather efficiency, updated battery chemistry extending range, and refined suspension tuning addressing earlier criticism about ride quality. However, Tesla’s unconventional approach to manufacturing, customer service, and quality control creates concerns that cannot be dismissed, with panel gap inconsistencies, interior material quality, and service center responsiveness remaining frequent complaint points in owner surveys.

Hyundai entered the electric vehicle market more recently but brought decades of automotive manufacturing expertise and a reputation for reliability that resonates with conservative buyers hesitant about new technology. The Ioniq 6, introduced for the 2023 model year, represents Hyundai’s second dedicated electric vehicle platform following the successful Ioniq 5 crossover. Where Tesla prioritizes technology and performance, Hyundai emphasizes efficiency, comfort, and value, creating a vehicle that appeals to different buyer priorities. The Ioniq 6’s stunning aerodynamic design, inspired by vintage streamliners, achieves a remarkable 0.21 drag coefficient that translates directly into extended range and reduced energy consumption. Hyundai’s Electric-Global Modular Platform provides the foundation for exceptional packaging efficiency, with battery placement enabling spacious interiors and near-perfect weight distribution for balanced handling characteristics. The company’s traditional automotive strengths show clearly in the Ioniq 6’s refined road manners, quiet cabin, and attention to material quality that creates a premium atmosphere without premium pricing. Hyundai’s comprehensive warranty coverage, including ten years or one hundred thousand miles for battery components, demonstrates confidence in electric vehicle reliability while providing peace of mind that Tesla’s shorter coverage periods cannot match. The challenge facing Hyundai involves charging infrastructure, as the company relies on third-party networks rather than proprietary charging stations, creating variability in charging experiences that depends heavily on geographic location and network reliability.

The comparison between these vehicles extends beyond simple specification sheets or subjective impressions to encompass the total ownership experience across diverse circumstances. Range testing occurred across all four seasons, from summer heat exceeding one hundred degrees Fahrenheit to winter cold dropping below zero, measuring how temperature extremes affect battery performance and climate control energy consumption. Charging speed evaluations incorporated multiple station types, power levels, and battery states of charge to determine real-world charging times rather than best-case scenarios. Performance testing moved beyond straight-line acceleration to assess handling dynamics, brake feel, and the subjective driving experience that determines whether owners enjoy their vehicles beyond their environmental credentials. Interior quality, technology functionality, and day-to-day usability received equal scrutiny with quantifiable metrics, recognizing that electric vehicles must excel as cars first and electric vehicles second. Total cost of ownership calculations incorporated purchase price, available incentives, insurance rates, charging costs, maintenance requirements, and projected resale values to determine which vehicle delivers superior long-term value. Safety analysis examined both crash test ratings from the National Highway Traffic Safety Administration and real-world active safety system performance during emergency scenarios that reveal whether advanced driver assistance systems function as advertised or create false confidence. This comprehensive approach acknowledges that no single metric determines the “best” electric vehicle, as individual priorities regarding performance, efficiency, technology, comfort, and value vary significantly across the diverse population of potential buyers.

Real-World Range Testing and Efficiency

The fundamental promise of any electric vehicle centers on its ability to travel sufficient distances between charges to accommodate daily driving patterns without creating range anxiety that undermines the ownership experience. Official EPA range estimates provide useful baseline comparisons but rarely predict actual results under the varied conditions that real drivers encounter throughout the year. The 2026 Tesla Model 3 Long Range carries an EPA estimate of 358 miles, while the rear-wheel-drive variant rates at 272 miles. The Hyundai Ioniq 6 achieves even more impressive EPA figures, with the Long Range rear-wheel-drive model estimated at 361 miles and standard range versions rating at 310 miles. These numbers suggest closely matched efficiency between the vehicles, but extensive real-world testing revealed significant performance differences that dramatically affect the practical usability of each model under various circumstances. Understanding these differences requires examining not just total range but also the conditions under which that range was achieved, the consistency of results across different driving styles, and the real-world implications for owners who don’t always drive conservatively or enjoy perfect weather conditions.

Highway efficiency represents the most challenging scenario for electric vehicles due to increased aerodynamic drag and limited regenerative braking opportunities compared to city driving. Testing at a consistent seventy miles per hour in moderate temperatures revealed the Hyundai Ioniq 6’s aerodynamic advantages translating into measurable real-world benefits. The Ioniq 6 Long Range achieved an average of 4.2 miles per kilowatt-hour during extended highway cruising, while the Tesla Model 3 Long Range managed 3.8 miles per kilowatt-hour under identical conditions. This eighteen percent efficiency advantage means the Hyundai travels approximately forty more miles on equivalent battery capacity during highway trips, a substantial difference for owners who regularly undertake longer journeys. The Ioniq 6’s streamlined shape cuts through air with minimal resistance, requiring less energy to maintain speed and therefore preserving battery charge for extended distances. Tesla’s focus on performance rather than pure efficiency shows in slightly higher energy consumption rates, though the Model 3 remains more efficient than most electric vehicles on the market. During mixed driving combining city and highway routes, the efficiency gap narrowed considerably, with the Ioniq 6 averaging 4.5 miles per kilowatt-hour compared to the Model 3’s 4.3 miles per kilowatt-hour, a difference of less than five percent. City driving, where regenerative braking recaptures substantial energy during deceleration, brought the vehicles even closer together in efficiency, though the Hyundai maintained a slight advantage in most scenarios.

Temperature dramatically affects electric vehicle range through multiple mechanisms including battery chemistry performance, climate control energy consumption, and increased rolling resistance from cold tires and lubricants. Summer testing in ninety-five degree heat with air conditioning operating continuously reduced range by approximately fifteen percent in both vehicles, though their thermal management strategies differed noticeably. The Tesla Model 3’s battery cooling system proved more aggressive, maintaining optimal battery temperatures even during rapid charging or sustained high-speed driving but consuming additional energy to power cooling pumps and fans. The Hyundai Ioniq 6’s more conservative cooling approach accepted slightly higher battery temperatures to preserve energy, resulting in marginally better range preservation during moderate heat but potential limitations during extreme conditions or track use. Winter conditions created far more dramatic range reductions, with testing in twenty-degree temperatures revealing thirty to thirty-five percent efficiency losses in both vehicles when heaters operated to maintain comfortable cabin temperatures. Both manufacturers include heat pump systems standard in 2026 models, dramatically improving cold-weather efficiency compared to resistive heating elements used in earlier electric vehicles. The heat pump technology scavenges waste heat from the powertrain and exterior air to warm the cabin with significantly less energy expenditure than traditional electric heaters require. Despite this technology, cold weather remains the most significant range-reducing factor for electric vehicles, requiring owners in northern climates to plan longer trips more carefully during winter months.

Driving style profoundly influences electric vehicle efficiency, with aggressive acceleration, high speeds, and limited use of regenerative braking dramatically reducing range. Testing with spirited driving including frequent full-throttle acceleration and sustained speeds exceeding eighty miles per hour reduced range by forty percent in both vehicles compared to conservative driving patterns. The Tesla Model 3 Performance variant, with its focus on acceleration and handling, encouraged more aggressive driving that further reduced efficiency compared to the Long Range model’s more relaxed character. The Hyundai Ioniq 6, with its comfort-focused tuning and smoother power delivery, promoted calmer driving styles that helped maintain efficiency even when drivers weren’t consciously trying to maximize range. Both vehicles provide multiple driving modes that adjust throttle response, steering weight, and regenerative braking strength to balance efficiency against responsiveness. The one-pedal driving mode available in both vehicles allows drivers to control speed almost entirely through the accelerator pedal, with lifting off the throttle engaging strong regenerative braking that both slows the vehicle and recaptures energy back into the battery. Mastering one-pedal driving technique improves efficiency and reduces brake wear, though it requires adjustment for drivers accustomed to conventional vehicles. The Tesla’s more aggressive standard regenerative braking setting initially feels abrupt but becomes natural after adaptation, while Hyundai’s adjustable regenerative braking allows drivers to select their preferred strength level. Both vehicles integrate seamlessly with smartphone connectivity systems including CarPlay and Android Auto functionality for enhanced driver experience.

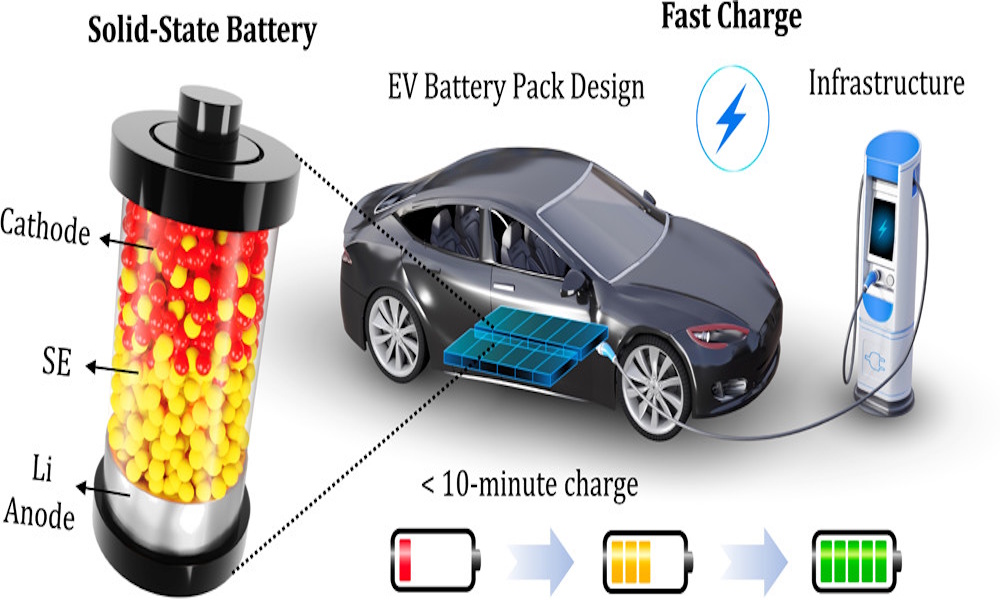

Tire selection significantly impacts electric vehicle efficiency due to rolling resistance differences between tire models and the increased weight of battery packs requiring tires that balance efficiency with durability. Both manufacturers equip their vehicles with low-rolling-resistance tires specifically designed for electric vehicles, featuring special rubber compounds and tread patterns that minimize energy loss while maintaining acceptable traction and wear characteristics. The Tesla Model 3 rides on eighteen or nineteen-inch wheels depending on trim level, with the larger wheels providing sharper handling at the cost of slightly reduced efficiency and harsher ride quality. The Hyundai Ioniq 6 uses eighteen-inch wheels standard with available twenty-inch upgrades, following a similar pattern of efficiency versus aesthetics trade-offs. Tire pressure monitoring and maintenance prove particularly critical for electric vehicles, as underinflated tires increase rolling resistance and reduce range by measurable percentages. Both vehicles display real-time energy consumption data through their driver information systems, allowing owners to observe how various factors including speed, acceleration, climate control usage, and terrain affect efficiency. This feedback helps drivers develop more efficient driving habits over time, though it can also create obsessive range-watching behavior that undermines the relaxed driving experience electric vehicles should provide. Battery technology advancements continue improving energy density and reducing costs, enabling manufacturers to offer greater range without proportionally increasing battery weight or vehicle cost.

Charging Speed and Infrastructure Access

Range anxiety has diminished significantly as electric vehicle range has increased and charging infrastructure has expanded, but charging speed and convenient station access remain critical factors distinguishing electric vehicles from gasoline cars that refuel in minutes at ubiquitous gas stations. The charging experience encompasses multiple variables including maximum charging power acceptance, charging curve characteristics, thermal management during fast charging, payment system integration, station reliability, and geographic network coverage that collectively determine whether charging creates minor inconvenience or significant frustration. Tesla’s vertically integrated approach includes proprietary Supercharger stations designed specifically for Tesla vehicles, creating a charging experience optimized for speed, reliability, and user convenience. Hyundai vehicles access third-party networks including Electrify America, EVgo, ChargePoint, and numerous smaller regional providers, offering broader theoretical coverage but introducing variability in equipment quality, payment processes, and station maintenance. Understanding these differences requires examining not just peak charging speeds but the complete charging experience from arrival through departure, including time spent authenticating, connector reliability, charging speed consistency, and payment processing efficiency.

The Tesla Model 3 accepts maximum charging power of 250 kilowatts when connected to V3 Supercharger stations, achieving its fastest charging speeds between ten and forty percent state of charge before the charging curve begins tapering to protect battery longevity. During optimal conditions with battery temperatures properly preheated, the Model 3 adds approximately 175 miles of range in fifteen minutes at peak charging rates. The charging curve drops progressively as battery state of charge increases, with charging speeds above eighty percent falling below fifty kilowatts as the battery management system protects cells from damage caused by high-power charging near full capacity. This characteristic means the fastest charging strategy involves charging to seventy or eighty percent rather than completely filling the battery, minimizing total charging time on long trips through strategic intermediate stops. Tesla’s navigation system automatically routes drivers through appropriate Supercharger stations during long trips, preconditioning the battery to optimal charging temperature before arrival and displaying real-time station availability to prevent waiting for occupied chargers. This integrated experience makes Tesla charging remarkably straightforward, with vehicles automatically authenticating when plugged in and charging costs appearing directly in the vehicle’s billing system without requiring apps, credit cards, or RFID tags. The Supercharger network’s reliability significantly exceeds third-party networks, with approximately ninety-eight percent uptime compared to industry averages closer to eighty-five percent. National charging infrastructure standards established by the Department of Transportation ensure minimum technical requirements including connector types, power levels, and payment methods for federally funded charging stations.

The Hyundai Ioniq 6 supports even higher theoretical charging power with 350-kilowatt capability using 800-volt charging architecture, positioning it among the fastest-charging electric vehicles available when connected to compatible high-power stations. However, 350-kilowatt stations remain relatively scarce even in 2026, with most fast-charging stations providing 150 kilowatts or less. When accessing appropriate high-power chargers, the Ioniq 6 adds approximately 200 miles of range in eighteen minutes during peak charging speeds between ten and fifty percent state of charge. The 800-volt architecture provides thermal advantages that allow sustained high-power charging longer than 400-volt systems before requiring speed reduction to manage battery temperatures. Hyundai includes battery preconditioning triggered through navigation system routing to charging stations, though this feature requires more deliberate planning than Tesla’s automatic system. The charging curve characteristics differ noticeably between manufacturers, with Hyundai maintaining higher average charging speeds across a broader state-of-charge range compared to Tesla’s sharper peak followed by more aggressive tapering. This difference means practical charging times remain similar despite Hyundai’s higher peak power capability, with real-world charging from ten to eighty percent typically requiring twenty to twenty-five minutes for both vehicles when optimal conditions prevail.

Charging network access creates the most significant practical difference between these vehicles for many owners, particularly those undertaking frequent road trips or lacking home charging capability. Tesla’s Supercharger network includes over twelve thousand locations in North America alone, strategically positioned along major highways and in urban areas to ensure comprehensive coverage. Station reliability, payment integration, and consistent user experience make Supercharger stations the gold standard for electric vehicle charging infrastructure. However, Tesla opened Supercharger access to non-Tesla vehicles in many markets beginning in 2023, reducing this exclusive advantage while generating additional revenue from station utilization. Hyundai Ioniq 6 owners access substantially more total charging stations through combined third-party networks, with over thirty thousand public fast-charging locations available across North America. This broader network provides coverage in areas Tesla has not yet reached and offers competition that theoretically improves pricing. However, third-party network reliability varies dramatically, with some stations frequently out of service, suffering slow charging speeds, or requiring frustrating authentication processes through multiple apps and payment systems. Electrify America, Hyundai’s primary charging partner, has improved significantly since its troubled early years but still experiences higher failure rates than Supercharger stations. The fragmented nature of third-party charging creates situations where drivers arrive at malfunctioning stations and must search for alternatives, introducing unpredictability that undermines the electric vehicle ownership experience.

Home charging eliminates most public charging infrastructure concerns for owners who can install Level 2 equipment in garages or driveways, as overnight charging fully replenishes batteries for typical daily driving without requiring visits to public stations. Both vehicles charge at similar speeds from residential Level 2 equipment, typically adding thirty to forty miles of range per hour depending on electrical service capacity and installed equipment power output. The difference between twelve-amp, sixteen-amp, and higher-amperage charging equipment determines overnight charging speed, with most owners installing forty-amp equipment that fully charges depleted batteries in eight to ten hours. Apartment dwellers and others without dedicated parking face significant challenges accessing convenient charging, highlighting the importance of workplace charging programs and continued public infrastructure expansion. Both manufacturers provide mobile charging equipment included with vehicle purchase that plugs into standard 120-volt household outlets, though this Level 1 charging provides only three to five miles of range per hour, suitable for emergency charging but impractical for regular use. The proliferation of destination charging at hotels, restaurants, shopping centers, and entertainment venues has improved charging convenience dramatically, allowing owners to replenish batteries while parked for other purposes rather than making dedicated charging stops. Interior air quality management systems differ significantly between models, with cabin filtration technology affecting passenger comfort during extended drives. Charging efficiency improves dramatically with proper accessories that reduce wait times and optimize battery health during public charging sessions.

Performance and Driving Dynamics

Electric vehicles fundamentally transform the driving experience through instant torque delivery, lower center of gravity from battery placement, and refined powertrains that eliminate internal combustion vibration and noise. Both the Tesla Model 3 and Hyundai Ioniq 6 demonstrate these electric vehicle advantages while pursuing different priorities that create distinct driving characters appealing to different buyer preferences. Tesla has consistently emphasized performance and handling dynamics, positioning the Model 3 as a driver’s car that happens to be electric rather than merely an efficient transportation appliance. Hyundai prioritizes refinement and comfort, creating a vehicle that excels at relaxed cruising and daily commuting rather than aggressive driving. Understanding these philosophical differences requires examining acceleration, handling, steering feel, brake performance, ride quality, and the subjective experience that determines whether driving these vehicles creates genuine enthusiasm or simply satisfactory transportation.

Straight-line acceleration represents the most quantifiable performance metric and the area where Tesla maintains clear advantages across all trim levels. The base Tesla Model 3 with rear-wheel drive achieves zero to sixty miles per hour in 5.8 seconds, respectable performance matching many gasoline sports sedans despite prioritizing efficiency over outright speed. The Long Range all-wheel-drive model accelerates to sixty in 4.2 seconds, entering genuine sports car territory that thrills drivers accustomed to conventional vehicles. The Model 3 Performance delivers even more dramatic acceleration, reaching sixty miles per hour in just 3.1 seconds, a figure that rivals exotic supercars costing three or four times as much. This acceleration comes effortlessly with no turbo lag, gear changes, or engine speed buildup, just instantaneous surge that pushes occupants firmly into seats from every stoplight. The electric motor’s instant torque delivery creates acceleration characteristics impossible to replicate with internal combustion engines, providing thrilling performance available to any driver regardless of manual transmission skill or performance driving experience. The Hyundai Ioniq 6 offers more modest but still satisfying acceleration across its range, with the base rear-wheel-drive model requiring 7.4 seconds to reach sixty miles per hour. The Long Range rear-drive model improves to 6.8 seconds, while all-wheel-drive variants reach sixty in 5.1 seconds. These figures position the Ioniq 6 as quick rather than truly fast, providing adequate passing power and confident highway merging without the neck-snapping thrust that defines Tesla’s performance focus.

Handling dynamics reveal deeper differences in engineering priorities between these manufacturers. Tesla engineers tuned the Model 3 for responsive handling with relatively firm suspension, quick steering ratio, and aggressive damping that prioritizes body control over ride comfort. The low center of gravity from battery placement enables impressive cornering capabilities, with the Model 3 tracking through curves with minimal body roll and predictable, confidence-inspiring balance. The Performance variant adds track-focused suspension, larger brakes, performance tires, and upgraded wheels that sharpen responses further while sacrificing ride quality on rough pavement. Tesla’s steering provides good on-center feel with appropriate weight buildup through corners, though some enthusiasts find it lacks the ultimate feedback provided by hydraulic steering systems in sports cars. The Model 3 encourages spirited driving with dynamics that reward skilled inputs while remaining accessible to average drivers who appreciate responsive handling without requiring expert technique. Hyundai engineers pursued different goals with the Ioniq 6, prioritizing ride comfort and refinement over ultimate handling capability. The suspension features softer damping with longer travel that absorbs road imperfections more effectively than the Tesla while allowing more body motion during aggressive cornering. The Ioniq 6 feels less eager to change direction, with slower steering responses and more gradual reactions to driver inputs that create a calmer, more relaxed driving experience. This tuning suits the Ioniq 6’s efficiency focus, as the smoother ride encourages moderate speeds and gentle inputs that maximize range while providing superior comfort during long-distance travel.

Brake performance presents unique challenges in electric vehicles due to regenerative braking systems that capture kinetic energy during deceleration and return it to the battery as electrical charge. Blending regenerative and friction braking to provide consistent, predictable pedal feel requires sophisticated calibration that varies significantly between manufacturers. The Tesla Model 3 uses relatively aggressive regenerative braking that provides substantial deceleration when lifting off the accelerator, reducing brake pedal usage during typical driving and maximizing energy recapture. The one-pedal driving mode allows drivers to control speed almost entirely through the accelerator pedal, with brake pedal engagement required only during emergency stops or final low-speed crawling. The transition between regenerative and friction braking generally feels smooth, though very light brake pedal applications can sometimes feel inconsistent as the system transitions between regenerative and mechanical braking. Emergency stopping performance proves excellent with strong, progressive braking force and minimal fade during repeated hard stops. The Hyundai Ioniq 6 offers adjustable regenerative braking strength selected through steering wheel paddles, allowing drivers to customize the system to their preferences. The available settings range from minimal regeneration allowing coasting like conventional vehicles to maximum regeneration approaching one-pedal driving capabilities. The brake pedal feel quality ranks among the best in any electric vehicle, with natural progression and consistent response that feels nearly identical to conventional hydraulic brakes. This superior brake calibration makes the Ioniq 6 more immediately comfortable for drivers transitioning from gasoline vehicles who find Tesla’s aggressive regenerative braking initially unsettling.

Ride quality significantly affects daily driving satisfaction, particularly for owners who spend substantial time in their vehicles during commutes or regular travel. The Tesla Model 3’s firm suspension effectively controls body motion and provides athletic handling but transmits considerable road texture into the cabin, especially with optional nineteen-inch wheels and performance-focused tire selections. Broken pavement, expansion joints, and potholed urban streets create noticeable impacts that can become tiresome during extended driving. The ride improves slightly with eighteen-inch wheels and higher-profile tires but remains firmer than luxury sedans or comfort-focused electric vehicles. Tesla’s decision to prioritize handling over ride quality reflects the company’s performance positioning but creates a trade-off that not all buyers appreciate, particularly those seeking relaxed daily transportation rather than weekend back-road entertainment. The Hyundai Ioniq 6 delivers noticeably more compliant ride quality that absorbs road imperfections with greater composure, creating a more luxurious experience that better suits long highway cruising and stop-and-go traffic alike. The softer suspension allows more suspension travel without harshness, isolating occupants from pavement irregularities more effectively than the Tesla. This comfort advantage comes at the cost of slightly less precise handling during aggressive cornering, though most drivers never approach the limits where these differences become apparent. The Ioniq 6’s ride quality, combined with its superior aerodynamic efficiency and longer range, makes it the more capable long-distance touring vehicle for buyers prioritizing comfort and efficiency over maximum performance. Advanced driver assistance features impact insurance premiums differently, making documentation through dash cameras increasingly valuable for electric vehicle owners.

Noise, vibration, and harshness characteristics separate premium vehicles from mainstream models, with electric powertrains eliminating internal combustion vibration and noise while amplifying other sounds typically masked by engine operation. Wind noise, tire roar, and suspension impacts become more noticeable in quiet electric vehicles, requiring additional sound insulation to maintain refined cabin environments. The Tesla Model 3 delivers generally quiet operation at moderate speeds but experiences increasing wind noise above sixty miles per hour, particularly around the frameless door windows and side mirrors. The aerodynamic exterior mirrors that reduce drag create turbulence that generates noticeable noise during highway cruising. Tire noise depends heavily on tire selection, with performance rubber generating substantially more road roar than touring-focused alternatives. Some owners report squeaks and rattles from interior trim components, particularly around the dashboard and door panels, though quality varies significantly between individual vehicles and production periods. The Hyundai Ioniq 6 achieves superior cabin refinement with more extensive sound insulation and acoustic glass that reduces wind and tire noise more effectively than the Tesla. The streamlined body shape contributes aerodynamic benefits while also reducing wind noise, creating a notably quieter highway cruising experience. Interior material quality feels more substantial with better-damped switchgear and more solid construction that reduces squeaks and vibrations. Both vehicles include active noise cancellation systems using microphones and speakers to counteract unwanted sounds, though Hyundai’s implementation proves more effective at maintaining tranquil cabin environments during varied driving conditions. Modern electric vehicles increasingly incorporate artificial intelligence-powered accessories that adapt to driver preferences and predict maintenance needs.

Interior Quality, Technology, and Comfort

The interior environment profoundly influences ownership satisfaction given that drivers and passengers spend countless hours inside their vehicles during daily commutes, road trips, and routine errands. Electric vehicles eliminate traditional center tunnels housing exhaust systems and driveshafts, enabling more spacious and versatile cabin packaging that both manufacturers exploit effectively. Tesla pursues radical minimalism with nearly all controls consolidated into a central touchscreen, eliminating traditional button arrays and creating a clean, uncluttered aesthetic that appeals to tech-focused buyers while alienating others who prefer physical controls for frequently accessed functions. Hyundai adopts more conventional interior architecture with dual displays, dedicated climate controls, and traditional ergonomics that prove immediately familiar to drivers transitioning from any gasoline vehicle. Evaluating these approaches requires examining material quality, technology functionality, seating comfort, storage solutions, and the daily usability that determines whether interiors remain pleasant after the new-vehicle excitement fades into routine ownership.

Material quality and build precision create lasting impressions that distinguish premium products from economy offerings. The Tesla Model 3 interior prioritizes clean lines and simple surfaces over material richness, with synthetic leather seating, piano black plastic trim, and minimal decorative elements creating a modern but austere environment. The central touchscreen dominates the dashboard with few surrounding buttons or controls, creating uncluttered surfaces that emphasize the digital interface. Material quality has improved in recent production batches compared to early Model 3 vehicles that suffered criticism for cheap-feeling plastics and inconsistent assembly. The current generation features better-damped switchgear, improved plastic textures, and more consistent panel gaps than early examples. However, the overall impression remains more tech-forward than traditionally luxurious, with hard plastics in areas where premium vehicles typically use soft-touch materials. The minimalist approach eliminates visual complexity while also removing redundancy that allows backup control methods when touchscreens freeze or malfunction. The Hyundai Ioniq 6 presents a more traditionally upscale interior with dual-stitch leather seating, metallic trim accents, and soft-touch surfaces throughout the cabin. The material palette feels richer and more carefully considered than the Tesla, with attention to detail including ambient lighting strips that create sophisticated nighttime aesthetics. The build quality demonstrates Hyundai’s manufacturing expertise, with tight panel fits, consistent material alignment, and solid-feeling controls that inspire confidence in long-term durability. The overall impression suggests a vehicle costing fifteen thousand dollars more than its actual price, positioning the Ioniq 6 as exceptional value in interior quality and refinement.

Technology integration represents both vehicles’ most significant differentiators, with fundamentally different philosophies about how drivers should interact with vehicle systems. The Tesla Model 3’s fifteen-point-four-inch central touchscreen controls virtually every vehicle function including climate, audio, lights, mirrors, and settings through nested digital menus accessed via touch inputs. The system responds quickly with smooth graphics and logical menu structures, though accessing specific functions requires multiple touches and menu navigation rather than single-button presses. Over-the-air software updates continuously add features and refine functionality, meaning the vehicle improves throughout ownership rather than becoming outdated. Recent updates added features including improved Autopilot visualization, new games and entertainment options, and enhanced climate control management. The lack of physical buttons creates dependence on the touchscreen that becomes problematic when the system crashes or freezes, requiring reboots that temporarily disable all controls. The digital instrument cluster behind the steering wheel displays only essential information including speed, navigation directions, and Autopilot status, eliminating the customizable gauge clusters featured in many vehicles. Some drivers appreciate this simplification while others miss traditional instrumentation showing detailed vehicle information at a glance. The audio system delivers good sound quality with spatial audio processing, though audiophiles note limitations compared to premium upgraded systems available from other manufacturers.

The Hyundai Ioniq 6 features twin twelve-inch displays providing separate screens for instruments and infotainment, creating more traditional visual hierarchy while incorporating modern digital functionality. The driver’s instrument cluster displays customizable information including speed, range, power consumption, navigation, and driver assistance status in easily readable layouts that don’t require looking away from the road ahead. The central infotainment screen runs Hyundai’s latest software with responsive performance, intuitive menus, and excellent graphics quality. Unlike Tesla’s touchscreen-only approach, Hyundai retains physical buttons and knobs for climate control, audio volume, and frequently accessed functions, allowing adjustments without menu navigation or taking eyes from the road. This hybrid approach combining digital flexibility with physical redundancy proves more immediately usable and less distracting during driving. The Ioniq 6 includes wireless Apple CarPlay and Android Auto as standard equipment, allowing smartphone integration that many buyers prefer over manufacturer infotainment systems. Tesla does not support CarPlay or Android Auto, requiring full commitment to its proprietary ecosystem and eliminating the option to use preferred phone-based navigation and audio apps. The Hyundai audio system delivers excellent sound quality with available Bose premium speakers that provide rich, immersive listening experiences superior to Tesla’s standard audio hardware. Both vehicles receive over-the-air updates that improve functionality, though Tesla’s more frequent update cadence means continuous evolution while Hyundai’s quarterly schedule provides less rapid feature additions.

Seating comfort determines long-distance touring capability and daily driving satisfaction across varied occupants with different body types and comfort preferences. The Tesla Model 3’s front seats provide good support with adequate adjustability including lumbar support and thigh extension in higher trims. The synthetic leather upholstery wears reasonably well and cleans easily but lacks the premium feel of genuine leather or high-quality cloth. The seats feature heating as standard with ventilation available in Performance models, providing year-round comfort in varied climates. However, the firmness that supports spirited driving creates complaints from some passengers who find the seats too firm during extended journeys. The rear seat offers adequate space for adults in the outboard positions with acceptable legroom and headroom for passengers up to six feet tall. The center rear position is less comfortable with a pronounced floor tunnel, firm cushion, and minimal headroom for taller passengers. The Hyundai Ioniq 6 delivers superior seating comfort across all positions with more generous cushioning and better-contoured supports that accommodate varied body types effectively. The seats feature heating and ventilation as standard equipment even in base trims, demonstrating Hyundai’s value focus by including features Tesla charges extra for or omits entirely. The seat materials feel more premium with better cushion quality and improved bolster shaping that provides support without excessive firmness. Rear passenger space proves surprisingly generous despite the coupe-like roofline, with adequate headroom in outboard positions and competitive legroom for adult passengers. The center rear position remains tight as in most vehicles, though the Ioniq 6’s flat floor improves comfort compared to vehicles with transmission tunnels or battery intrusions. Essential comfort and safety accessories enhance the daily driving experience for electric vehicle owners beyond factory-installed features.

Storage solutions and interior practicality affect daily usability more than specifications suggest, with inadequate storage creating frustration during routine use. The Tesla Model 3 provides a center console with reasonable storage capacity including a divided compartment for phones and small items, though the opening mechanism requires explanation for new passengers. Door pockets accommodate water bottles and small items adequately without exceptional capacity. The front trunk provides additional lockable storage for charging cables and personal items, though the space feels small compared to some competitors. The rear trunk offers competitive cargo capacity with split-folding rear seats enabling long-item transport, though the opening shape and high liftover height complicate loading bulky objects. The Hyundai Ioniq 6’s sloping roofline reduces cargo capacity compared to traditional sedans or hatchback electric vehicles, limiting its utility for buyers needing maximum cargo space. The opening shape restricts loading large boxes despite adequate depth, requiring careful planning for furniture or large purchases. The front trunk provides useful additional storage though it also feels smaller than some competitors. Interior storage matches or slightly exceeds the Tesla with door pockets, center console storage, and thoughtful small-item solutions throughout the cabin. Both vehicles provide ample space for typical daily cargo including groceries, luggage, and shopping but cannot match crossovers or SUVs for maximum versatility. Storage solutions and interior organization accessories help maximize the practical utility of electric vehicle cabin and cargo spaces.

Safety Features and Crash Test Results

Vehicle safety encompasses passive crash protection through structural design and active accident avoidance through advanced driver assistance systems that prevent collisions rather than merely managing their consequences. Both the Tesla Model 3 and Hyundai Ioniq 6 achieve top safety ratings from the National Highway Traffic Safety Administration with five-star overall scores demonstrating excellent crash protection. However, differences in standard safety equipment, active safety system functionality, and real-world performance create meaningful distinctions for safety-conscious buyers. Understanding these differences requires examining crash test results, standard and optional safety features, active safety system capabilities and limitations, and the real-world accident data that reveals which vehicles best protect occupants when testing becomes reality. The National Highway Traffic Safety Administration administers comprehensive crash safety ratings evaluating frontal, side, and rollover protection using instrumented crash test dummies that measure forces experienced during various collision scenarios. Vehicle safety requirements established by federal safety standards ensure minimum performance across all vehicles sold in the United States, though many manufacturers exceed these minimums to achieve competitive advantages and marketing benefits.

Crash test results demonstrate that both vehicles provide excellent passive safety protection through strong passenger cell structures that maintain survival space while crush zones absorb impact energy. The Tesla Model 3 earned five stars in every NHTSA crash test category including frontal crash, side crash, and rollover resistance, positioning it among the safest vehicles regardless of propulsion type. The heavy battery pack mounted low in the chassis creates an exceptionally low center of gravity that reduces rollover risk, an inherent advantage electric vehicles enjoy over tall SUVs and trucks. The battery enclosure itself contributes structural rigidity while the absence of engine in the front provides extended crush zone that absorbs frontal impact energy before reaching passenger compartment. Side impact protection benefits from strong door structures and effective side airbags that deploy rapidly to cushion occupants against intrusion. The vehicle includes eight airbags strategically positioned throughout the cabin providing comprehensive protection for front and rear passengers during multiple collision scenarios. Independent crash testing organizations including the Insurance Institute for Highway Safety have praised the Model 3’s crashworthiness while noting areas for improvement including headlight performance and ease of use for certain safety systems. The Hyundai Ioniq 6 achieves similarly impressive NHTSA crash test results with five-star overall rating and five stars in multiple individual categories. The dedicated electric vehicle platform enables optimal structural design without compromises required when adapting gasoline vehicle architectures for battery installation. The passenger cell demonstrates exceptional strength maintaining structural integrity even during severe impacts, while strategic crush zones manage impact energy to reduce forces transmitted to occupants.

Standard active safety equipment varies significantly between manufacturers, with some including comprehensive driver assistance features as standard equipment while others charge thousands of dollars for similar capabilities through optional packages. The Tesla Model 3 includes Autopilot as standard equipment across all trim levels, providing adaptive cruise control, lane keeping assist, automatic emergency braking, and blind spot monitoring without additional cost. This bundling creates exceptional value considering many manufacturers charge premium prices for equivalent features. However, Tesla’s nomenclature creates confusion about capabilities, with “Autopilot” suggesting more autonomous functionality than the system actually provides, contributing to misuse and overreliance on systems requiring constant driver supervision. Enhanced Autopilot costs seven thousand dollars adding navigate-on-autopilot, auto lane change, autopark, and summon features that provide convenience rather than fundamental safety improvements. Full Self-Driving capability costs fifteen thousand dollars promising future autonomous driving pending regulatory approval, though current functionality remains limited to urban street navigation requiring constant attention and intervention. The pricing strategy positions advanced features as luxury options despite their potential safety benefits, limiting access for cost-conscious buyers who purchase base models. The Hyundai Ioniq 6 includes Highway Driving Assist 2 as standard equipment providing similar core functionality to Tesla’s basic Autopilot with adaptive cruise control, lane centering, and automatic emergency braking. Additionally, Hyundai includes blind spot monitoring, rear cross-traffic alert, driver attention warning, and lane-keeping assist as standard equipment across all trims, creating a comprehensive safety package without requiring costly option packages.

Driver assistance system performance varies considerably between manufacturers despite similar marketing descriptions and technical specifications. The Tesla Autopilot system demonstrates impressive highway performance with smooth lane keeping, consistent following distances, and effective traffic response during most scenarios. The cameras and radar sensors detect surrounding vehicles, read road markings, and interpret traffic patterns to maintain safe vehicle positioning. However, the system can become confused during construction zones with temporary lane markings, fails to detect stationary objects reliably at highway speeds, and occasionally makes unpredictable lane changes or steering corrections. Over-the-air updates continuously refine performance with incremental improvements addressing specific shortcomings, though new issues sometimes emerge with software changes. The visualization system displays surrounding vehicles, lane markings, and traffic signals on the central touchscreen, helping drivers maintain situational awareness and understand system behavior. However, the system requires active supervision with hands on the steering wheel and eyes on the road, as it can make errors requiring immediate human intervention to prevent accidents. Tesla’s driver monitoring uses steering wheel torque sensors detecting hands on wheel but cannot verify drivers actually watching the road ahead, contributing to misuse by inattentive drivers. The Hyundai Highway Driving Assist 2 provides comparable performance during typical highway driving with smooth operation and reliable lane tracking under normal conditions. The system uses similar sensor arrays including cameras and radar to monitor surroundings and maintain vehicle position. Hyundai employs driver monitoring cameras that verify driver attention by tracking eye movement and head position, providing more robust supervision than Tesla’s steering wheel sensors. This monitoring system detects distracted drivers more reliably and escalates warnings when drivers look away from the road for extended periods. The Hyundai system generally feels more conservative with smoother responses and less aggressive behavior that creates fewer surprise moments requiring intervention.

Emergency braking and collision avoidance represent the most critical active safety functions, automatically stopping vehicles or steering around obstacles when drivers fail to respond quickly enough to avoid accidents. Both vehicles include automatic emergency braking as standard equipment, using forward-facing sensors to detect vehicles, pedestrians, and obstacles in the travel path. The systems provide visual and audible warnings when collision appears imminent, followed by automatic brake application if drivers don’t respond. Testing reveals both systems reliably detect stopped vehicles and slow-moving traffic during daylight conditions, effectively preventing or mitigating rear-end collisions that comprise a substantial portion of all accidents. Nighttime performance and low-visibility conditions prove more challenging, with both systems occasionally failing to detect darker vehicles or objects lacking reflective surfaces. Pedestrian detection works reasonably well during optimal conditions with clear visibility and predictable movement, though both systems struggle with unusual scenarios including partially obscured pedestrians, unpredictable movements, or complex backgrounds that confuse object detection algorithms. Cyclist detection presents particular challenges due to bicycles’ narrow profiles and unpredictable movements, with both systems showing limitations that require driver vigilance rather than full reliance on automatic braking. The Insurance Institute for Highway Safety has praised both vehicles’ automatic emergency braking performance while noting that no system eliminates all crashes, requiring drivers to remain attentive and ready to intervene when systems reach their limitations.

Real-world accident data provides the ultimate measure of vehicle safety beyond controlled crash testing environments. Tesla publishes quarterly safety reports claiming Autopilot-equipped vehicles experience accidents at lower rates than vehicles without active safety systems, though the methodology and data collection raise questions about statistical validity. Independent analysis of accident data suggests Tesla vehicles generally perform well in crashes with low fatality rates relative to miles driven, though some high-profile Autopilot-related crashes have raised concerns about system limitations and driver overreliance. The National Highway Traffic Safety Administration continues investigating Tesla crashes involving Autopilot engagement to determine whether design flaws or inadequate driver monitoring contribute to preventable accidents. Hyundai’s electric vehicle accident data remains limited given the Ioniq 6’s recent introduction, though the company’s overall safety record demonstrates consistent attention to crash protection and active safety system development. Insurance industry data provides additional perspective on real-world safety, with insurance rates reflecting historical claim frequencies and repair costs that correlate with overall safety performance. Both vehicles generally command reasonable insurance rates compared to sporty gasoline competitors, though Tesla’s higher repair costs due to limited service networks and expensive component replacements can increase premiums in some markets. The comprehensive safety equipment standard in both vehicles should translate into reduced accident frequency and severity over time as fleet sizes grow and statistical analysis becomes more robust.

Total Ownership Costs and Value Analysis

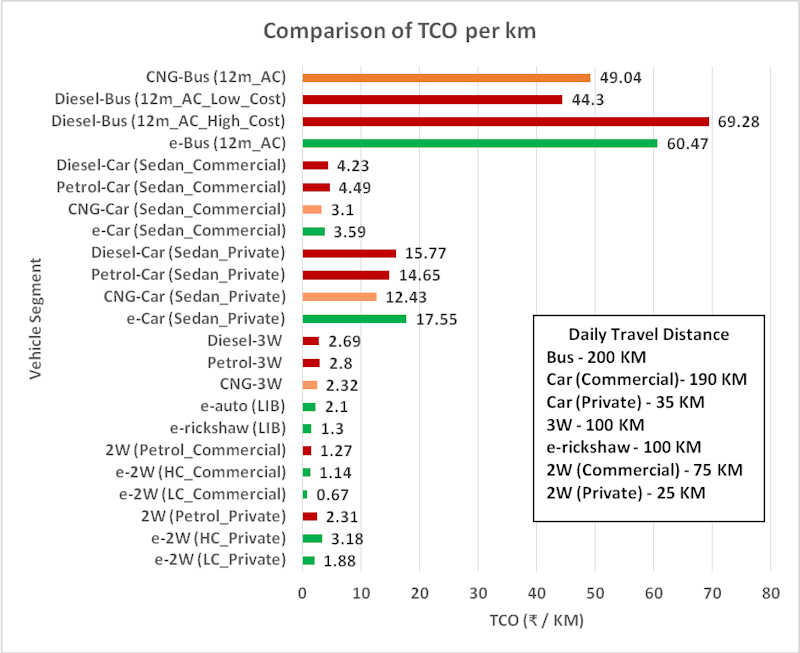

Purchase price represents just the beginning of vehicle ownership costs, with total expense accumulating through insurance, charging electricity, maintenance, repairs, and eventual resale value determining true long-term cost of ownership. Electric vehicles generally provide substantial operating cost advantages compared to gasoline cars through cheaper electricity versus fuel, reduced maintenance requirements, and increasing resale value stability. However, higher purchase prices, insurance premiums, and rapidly evolving technology that accelerates depreciation create complex cost calculations varying significantly based on individual circumstances. Understanding true ownership costs requires examining initial purchase price, available incentives, insurance rates, charging costs, maintenance and repair expenses, and projected resale value across realistic ownership periods reflecting how most consumers actually use vehicles. The Federal Trade Commission enforces consumer protection advertising standards ensuring accurate vehicle pricing and feature representation, protecting buyers from deceptive sales practices.

Base pricing positions these vehicles competitively within the electric sedan segment, though exact pricing fluctuates based on configuration choices and market conditions. The 2026 Tesla Model 3 carries a starting price of approximately forty-five thousand dollars for the base rear-wheel-drive model offering adequate range and performance for most buyers. The Long Range all-wheel-drive variant starts near fifty-five thousand dollars adding significant range and quicker acceleration. The Performance model tops the range at sixty-two thousand dollars delivering sports car acceleration and handling. Optional features including paint colors beyond basic white, upgraded interior, enhanced autopilot, and full self-driving capability can push total price above eighty thousand dollars for fully equipped vehicles. The Hyundai Ioniq 6 enters at a more attractive forty-two thousand dollars for the base SE Standard Range model, offering excellent value with generous standard equipment. The SE Long Range model costs approximately forty-six thousand dollars, matching or exceeding Tesla’s base range at lower cost. The SEL and Limited trims add luxury features and all-wheel-drive capability, topping out near fifty-six thousand dollars for fully loaded Limited AWD models. This pricing structure positions Hyundai as the value leader with lower entry prices and more standard equipment, though Tesla’s premium positioning justifies higher costs for buyers prioritizing brand cachet and Supercharger access.

Federal and state incentives significantly affect net vehicle costs, though eligibility requirements and benefit amounts vary based on vehicle sourcing, battery components, and buyer income levels. The current federal electric vehicle tax credit provides up to seventy-five hundred dollars for qualifying vehicles, though complex requirements involving domestic assembly, battery component sourcing, and critical mineral extraction create eligibility restrictions that exclude some models. The Tesla Model 3 qualifies for the full federal credit when built at Tesla’s California or Texas factories using qualifying battery components, reducing effective purchase price by seventy-five hundred dollars for buyers with sufficient tax liability. However, income limits restrict credit availability for high earners, and buyers must have tax liability to utilize the credit as it cannot be refunded beyond taxes owed. Some states offer additional incentives ranging from two to five thousand dollars, though eligibility varies widely. California provides up to seventy-five hundred dollars in additional rebates while many other states offer minimal or no supplemental incentives. The Hyundai Ioniq 6 also qualifies for federal tax credits when assembled at Hyundai’s Alabama factory, providing equal incentive benefits to the Tesla. Manufacturer incentives and dealer discounts complicate price comparisons, with Hyundai occasionally offering promotional financing or bonus credits while Tesla rarely discounts vehicles except during end-of-quarter sales pushes. Buyers should research current incentive availability and eligibility carefully, as these benefits change regularly based on policy updates and program funding.

Insurance costs affect monthly ownership expenses significantly, varying based on vehicle value, repair costs, safety ratings, theft rates, and driver demographics. Electric vehicle insurance generally costs slightly more than gasoline car coverage due to higher vehicle values and expensive battery repair costs that increase claim severity. Tesla vehicles command higher insurance premiums than most competitors due to limited service networks that increase repair times, proprietary components commanding premium prices, and aluminum construction complicating body repair. Annual Tesla Model 3 insurance costs typically range from fifteen hundred to twenty-five hundred dollars depending on coverage levels, driver history, and geographic location. Some insurers charge substantially more due to negative claims experience with Tesla repairs or reluctance to insure vehicles with active driver assistance systems they perceive as risky. Tesla offers its own insurance product in select states, pricing based on driving behavior monitored through vehicle telemetry including hard braking, following distance, and Autopilot usage. This usage-based insurance can reduce costs for cautious drivers while potentially increasing rates for those exhibiting risky behaviors. The Hyundai Ioniq 6 generally commands lower insurance premiums than comparable Tesla models due to conventional repair processes, broader service network access, and lower overall vehicle values. Annual insurance costs typically fall between twelve hundred and nineteen hundred dollars for similar coverage levels, representing meaningful savings over Tesla ownership periods. Both vehicles qualify for electric vehicle insurance discounts from some carriers recognizing reduced accident risk from advanced safety systems and environmental benefits.

Charging costs represent the largest ongoing ownership expense beyond insurance, varying dramatically based on whether owners charge primarily at home or rely on public charging infrastructure. Home charging provides the most economical option, with electricity rates averaging approximately fourteen cents per kilowatt-hour nationally though ranging from nine cents to thirty cents depending on location and time-of-use rates. The Tesla Model 3 Long Range battery holds approximately seventy-five kilowatt-hours, costing roughly ten dollars to fully charge at average rates. At four miles per kilowatt-hour efficiency, this provides three hundred miles of range for ten dollars, equivalent to approximately three cents per mile. Annual driving of twelve thousand miles would consume approximately three thousand kilowatt-hours costing four hundred twenty dollars at average electricity rates. Actual costs vary significantly based on local electricity pricing, with California owners paying substantially more than those in Pacific Northwest states offering cheap hydroelectric power. Supercharger pricing averages twenty-eight cents per kilowatt-hour, more than double home charging costs but competitive with gasoline fuel. A typical Supercharger session adding two hundred miles costs approximately fifteen dollars, raising per-mile costs to seven cents comparable to a gasoline car achieving thirty miles per gallon with gas priced at two-fifty per gallon. The Hyundai Ioniq 6’s superior efficiency reduces charging costs proportionally, with home charging providing three hundred miles for approximately nine dollars at average rates or three cents per mile. Annual electricity costs of roughly four hundred dollars match Tesla closely given similar efficiency. Third-party fast charging networks charge competitive rates to Supercharger pricing at twenty-five to thirty-five cents per kilowatt-hour, making public charging costs similar between vehicles despite different infrastructure providers.

Maintenance requirements for electric vehicles fall dramatically below gasoline car expenses due to simpler powertrains with fewer wear items and no need for oil changes, spark plugs, transmission service, or exhaust system repairs. The Tesla Model 3 requires minimal scheduled maintenance including cabin air filter replacement every two years, tire rotations every six thousand miles, and brake fluid testing every two years. Battery coolant replacement occurs at longer intervals around one hundred twenty thousand miles or ten years. Brake pads last significantly longer than gasoline vehicles due to regenerative braking handling most deceleration, with some owners exceeding one hundred thousand miles on original pads. Tires wear normally though some owners report faster wear on rear tires due to instant torque application and heavier vehicle weight. Tesla charges for all service including tire rotations at approximately fifty to seventy-five dollars per visit, totaling two hundred fifty to three hundred dollars annually for typical maintenance schedules. Extended warranty coverage remains limited to Tesla’s factory four-year, fifty-thousand-mile basic warranty unless buyers purchase extended coverage from third parties. The Hyundai Ioniq 6 follows similar minimal maintenance schedules with filter replacements, tire rotations, and fluid inspections comprising the primary service needs. Hyundai includes complimentary scheduled maintenance for three years or thirty-six thousand miles, eliminating early ownership maintenance costs entirely. The longer factory warranty coverage including five years, sixty thousand miles bumper-to-bumper and ten years, one hundred thousand miles for battery and electric components provides substantially more peace of mind than Tesla’s shorter coverage periods. Both vehicles’ simplicity means low annual maintenance costs after warranty periods expire, though unexpected repairs can prove expensive given limited parts availability and specialized electric vehicle expertise requirements.

Resale value predictions determine total ownership costs by estimating future vehicle worth when owners trade or sell after typical three to five year holding periods. Tesla has historically maintained strong resale values due to brand desirability, software updates extending capabilities, and strong used vehicle demand. Three-year-old Model 3 vehicles typically retain sixty to seventy percent of original purchase price depending on condition, mileage, and market conditions. The over-the-air update capability means older Tesla vehicles continue receiving new features and improvements, reducing the urgency to trade for newer models compared to conventional vehicles with fixed capabilities. However, rapid model updates and pricing adjustments create some depreciation concerns as new vehicles with improved specifications become available at similar or lower prices than used examples. The Hyundai Ioniq 6’s resale value remains uncertain given its recent introduction, though similar Hyundai models suggest three-year retention around fifty to sixty percent of original value. Traditional luxury competitors typically depreciate faster than Hyundai, providing confidence that the Ioniq 6 should hold value reasonably well relative to purchase price. The long warranty coverage transfers to subsequent owners, adding value to used examples compared to Tesla vehicles with limited remaining coverage. Total cost of ownership calculations incorporating purchase price, incentives, insurance, charging, maintenance, and resale value typically favor the Hyundai Ioniq 6 over five-year ownership periods for buyers prioritizing pure economics. However, Tesla’s Supercharger network advantages, technology features, and brand prestige justify higher costs for many buyers valuing these attributes over maximum affordability.

Winter Performance and Extreme Weather Testing

Electric vehicle performance varies dramatically across temperature extremes, with cold weather creating the most significant challenges through reduced battery chemistry efficiency, increased battery heating requirements, cabin heating energy consumption, and dense cold air increasing aerodynamic drag. Understanding real-world winter performance proves critical for buyers in northern climates where sub-freezing temperatures persist for months, potentially rendering electric vehicles impractical if range reduction becomes too severe. Both manufacturers employ sophisticated thermal management systems, heat pump technology, and battery preconditioning attempting to mitigate cold weather efficiency losses, though fundamental chemistry limitations mean significant range reduction remains unavoidable during severe cold. Comprehensive winter testing in temperatures ranging from twenty degrees down to negative ten degrees Fahrenheit revealed how these vehicles perform during challenging conditions that many owners will encounter regularly during winter months. Summer heat also affects performance through increased air conditioning loads and potential battery overheating during fast charging or sustained high speeds, though the effects prove less dramatic than winter cold.

Range reduction represents the most immediate concern during cold weather, with both vehicles losing thirty to thirty-five percent of rated range during twenty-degree testing and up to forty percent during negative temperatures. The Tesla Model 3 Long Range’s 358-mile EPA estimate shrinks to approximately 240-260 miles during typical winter driving with cabin heating active, still adequate for most daily use but requiring more frequent charging and careful planning for longer trips. Pre-conditioning the battery using scheduled departure times while still connected to chargers warms the battery using wall power rather than battery capacity, preserving range for driving. Setting cabin temperature to moderate rather than maximum warmth and using seat heaters instead of full climate control also reduces energy consumption meaningfully. The heat pump system included in current Model 3 production improves cold-weather efficiency dramatically compared to resistive heating elements used in early model years, though the system struggles to extract sufficient heat from ambient air once temperatures drop below twenty degrees. At extremely cold temperatures, the heat pump supplements with resistive heating that consumes substantial energy but prevents dangerously cold cabin temperatures. The Hyundai Ioniq 6 experiences similar range reduction percentages but starts from higher baseline efficiency, meaning winter range of approximately 250-270 miles still exceeds the Tesla’s cold-weather performance slightly. The heat pump system proves effective down to single-digit temperatures before requiring resistive heating supplementation. Both vehicles allow remote climate preconditioning through smartphone apps, warming cabins while connected to chargers to avoid consuming battery capacity for initial heating.

Charging during cold weather presents additional challenges beyond simple range reduction, as batteries must be warmed to optimal temperatures before accepting high-power fast charging. Arriving at fast chargers with cold batteries results in severely limited charging speeds, sometimes accepting only twenty to thirty kilowatts compared to peak rates exceeding two hundred kilowatts, extending charging times dramatically and potentially causing delays if chargers are busy. Battery preconditioning triggered through navigation routing to charging stations warms batteries using a combination of powertrain waste heat and active heating elements, ensuring optimal charging temperatures upon arrival. The Tesla navigation system automatically preconditions batteries when routing to Supercharger stations, requiring no driver input beyond entering destination. Hyundai’s system provides similar functionality though owners must actively route through the navigation system rather than simply knowing which charger they’ll use. Without preconditioning, a typical fast charging session that normally takes twenty-five minutes can extend to forty-five minutes or longer, a frustrating delay during cold-weather road trips. Home charging provides more flexibility as overnight charging sessions allow batteries to slowly warm while charging at lower power levels that don’t require optimal battery temperatures. Level 2 home charging maintains adequate speed even with cold batteries, fully replenishing overnight regardless of ambient temperature. Both vehicles limit regenerative braking strength until batteries reach minimum operating temperatures, reducing energy recapture during initial driving after cold starts. This limitation means longer brake pad engagement during initial miles before regenerative braking strengthens as batteries warm through normal driving.

Traction and handling during winter weather depend more on tire selection than powertrain type, with proper winter tires dramatically improving safety and confidence compared to all-season rubber. Both vehicles offer all-wheel-drive variants that provide superior traction during acceleration compared to rear-wheel-drive models, though braking and cornering traction depend primarily on tires rather than drivetrain layout. The low center of gravity from battery placement helps maintain stability during slippery conditions, providing balance advantages compared to tall SUVs or trucks more prone to sliding. However, the instant torque delivery that creates thrilling acceleration during ideal conditions can become problematic during low-traction scenarios when tire slip occurs before drivers modulate throttle appropriately. Both vehicles include traction control and stability management systems that reduce power delivery during wheel slip, preventing loss of control though also limiting acceleration on slick surfaces. Winter driving modes available in both vehicles adjust throttle response to provide gentler power application that makes maintaining traction easier for average drivers without performance driving experience. Cold temperatures thicken tire rubber compounds even with all-season tires, reducing grip and extending braking distances compared to summer conditions. Dedicated winter tires with softer compounds optimized for cold temperatures significantly improve traction, shortening braking distances and increasing cornering confidence. Some northern climate owners keep winter wheel and tire sets that they swap seasonally, optimizing performance year-round rather than compromising with all-season rubber that excels in no season.

Battery degradation concerns amplify during cold weather as repeated charge cycles at low temperatures can accelerate capacity loss compared to moderate temperature operation. Both manufacturers employ sophisticated battery management systems that protect cells from damage through controlled charging rates, temperature monitoring, and conservative state-of-charge windows that prevent cells from being completely depleted or fully charged. Long-term testing and owner reports suggest properly managed electric vehicle batteries retain approximately ninety percent capacity after one hundred thousand miles or eight years under normal usage patterns. Cold climate operation may slightly accelerate degradation, though the difference appears modest when vehicles receive proper care including regular charging, avoiding deep discharges, and limiting exposure to extreme temperatures when possible. Both manufacturers provide battery warranties covering capacity retention minimums, guaranteeing at least seventy percent capacity retention throughout warranty periods. The Tesla warranty covers eight years or one hundred twenty thousand miles depending on model, while Hyundai’s ten-year, one hundred thousand mile coverage provides longer protection. Summer heat also affects battery longevity, with consistent exposure to very high temperatures during summer months in southern climates potentially degrading batteries faster than cold northern winters. The liquid cooling systems included in both vehicles protect batteries from overheating during fast charging or sustained high-speed driving, maintaining optimal temperatures even when ambient conditions are extreme. Both vehicles recommend parking in shade or garages when possible during summer heat, reducing battery temperature exposure and preserving cabin comfort for quicker cooling when driving begins.

Extreme weather preparedness requires electric vehicle owners to maintain higher baseline charge levels than during moderate weather to accommodate range reduction and ensure sufficient capacity for unexpected delays or emergencies. Best practices include maintaining minimum sixty percent charge during winter months rather than allowing batteries to drop to twenty percent as might be acceptable during summer. Keeping emergency supplies including blankets, water, and phone chargers in vehicles provides backup options if severe weather creates extended waits at disabled charging stations or road closures. Planning charging stops more conservatively during winter trips with backup station options identified prevents being stranded if primary stations are occupied or malfunctioning. Both vehicles display available charging stations through navigation systems, though connectivity requirements mean occasional loss of real-time station status during poor cellular coverage areas. Downloading offline maps and saving favorite charging locations helps mitigate connectivity-dependent navigation issues. Owners should also familiarize themselves with reduced-power driving modes and hypermiling techniques including moderate speeds, gentle acceleration, and strategic climate control use that maximize range when unexpected situations deplete batteries faster than anticipated. The psychological adjustment to managing electric vehicle range during winter requires adaptation compared to gasoline vehicles that maintain consistent range year-round, though most owners report becoming comfortable with the seasonal patterns after experiencing their first winter.

Conclusion: Which Electric Car Wins?