Jewelry Investment Guide: Pieces That Increase in Value

Table of Contents

- Introduction: The $47,000 Lesson That Changed How I View Jewelry

- The Brutal Truth About Jewelry as Investment Assets

- Understanding Retail Markup: Why Most Jewelry Loses Value Immediately

- Investment-Grade vs Consumer Jewelry: Critical Distinctions

- Diamond Investment: The Colorless Trap vs Rare Colors

- Gold Jewelry Investment: Karat Weight and Design Considerations

- Platinum and Alternative Precious Metals

- Colored Gemstones: Rubies, Sapphires, and Emeralds

- Rare Gemstones: Investment Potential of Alexandrite and Paraiba

- Signed Pieces: The Brand Premium That Actually Pays

- Vintage and Antique Jewelry: Age as Value Driver

- Auction vs Retail: Where Smart Investors Buy

- Authentication and Certification: Protecting Your Investment

- Insurance, Storage, and Carrying Costs

- Tax Implications of Jewelry Investment

- Market Timing: When to Buy and Sell

- Building a Jewelry Investment Portfolio

- Exit Strategies: Maximizing Resale Value

- Common Mistakes That Destroy Returns

- Conclusion: Strategic Approach to Jewelry Investment

- Frequently Asked Questions

Introduction: The $47,000 Lesson That Changed How I View Jewelry

The stunning three-carat diamond solitaire engagement ring sparkled brilliantly under the jewelry store lights as the sales associate explained that the VS1 clarity, G color diamond set in platinum represented an excellent investment that would appreciate steadily over our marriage while providing my fiancée with a beautiful symbol of our commitment. The forty-seven thousand dollar price tag seemed justified by the impressive specifications, the prestigious Fifth Avenue location suggesting quality and expertise, and the confident assurances that diamonds always increase in value making the purchase both romantic gesture and sound financial decision that would preserve and grow wealth over decades while my wife enjoyed wearing the investment on her finger daily.

I purchased that ring with complete confidence that I’d made a wise decision balancing emotional significance with financial prudence, believing the dealer’s claims about investment potential backed by my own vague understanding that diamonds were valuable rare commodities that naturally appreciated over time. The ring looked spectacular, my fiancée loved it, and I felt satisfied that the substantial expense represented an asset investment rather than pure consumption spending that would leave nothing of value after the emotional satisfaction faded.

Three years later, our marriage ended in divorce requiring asset division including the engagement ring that my ex-wife agreed to sell with proceeds split between us according to the divorce settlement. I expected to recover most or all of the original forty-seven thousand dollar purchase price given the ring’s pristine condition, proper care, and the three years of appreciation that the dealer had assured me would occur. The shocking reality of what that “investment” ring actually sold for destroyed my comfortable assumptions about jewelry value and initiated a deep investigation into the economics of jewelry as investment that revealed how thoroughly the industry misleads consumers about appreciation potential while extracting enormous profits through markups that make most jewelry purchases financially disastrous regardless of emotional value.

While the following demonstration highlights whether jewelry is a worthwhile investment for 2026, there is still information and strategies hidden within the exclusive details later in this article—information you may not have discovered yet :

The ring sold for eighteen thousand five hundred dollars at auction after multiple attempts to sell privately at higher prices produced no serious offers from buyers who knew actual diamond market values rather than inflated retail prices. The fifty thousand dollar retail purchase price that I’d paid three years earlier translated to barely more than one-third recovered value representing nearly thirty thousand dollar loss on a purchase that was supposed to be an appreciating investment protecting wealth while providing aesthetic enjoyment. The devastating financial loss would have been bad enough if the ring had simply maintained its value without appreciation, but losing sixty percent of purchase price exposed that I’d paid enormous premium over actual asset value through retail markup that the dealer conveniently forgot to mention while emphasizing investment potential and assured appreciation.

The investigation into what went wrong with my “investment” revealed the harsh realities of jewelry economics that dealers never disclose to customers making purchases based on romantic occasion and emotional decision-making rather than cold financial analysis. The typical retail jewelry store markup ranges from two hundred to four hundred percent over wholesale cost, meaning a diamond and setting that costs the dealer twelve thousand dollars gets sold to consumers for forty to fifty thousand dollars through markups that dwarf profit margins in virtually any other retail category. The enormous markup ensures that even if the underlying diamond and precious metal appreciate modestly over time, the retail buyer never recovers enough value to profit and often can’t even break even unless they hold pieces for decades allowing appreciation to slowly offset the initial markup disadvantage.

But the markup problem represented only the beginning of the issues making standard retail jewelry purchases terrible investments despite dealer claims otherwise. The diamond I’d purchased—a standard colorless stone with good but not exceptional characteristics—belonged to the commodity category of diamonds that rarely appreciate beyond inflation rates because supply meets or exceeds demand for standard stones that thousands of customers buy monthly creating no scarcity premium. The real investment-grade diamonds that actually appreciate substantially are rare colored stones, exceptionally large colorless diamonds above five carats, or historically significant pieces with provenance documentation that standard retail purchases lack entirely.

The setting design that looked contemporary and fashionable when I purchased the ring had already begun dating after just three years, with engagement ring trends shifting toward different styles making my ring appear distinctly “three years ago” rather than timeless classic design maintaining appeal indefinitely. The fashion depreciation meant that even if the diamond held value, the setting itself became liability reducing overall piece desirability to buyers who wanted current styles rather than purchasing yesterday’s fashion at premium prices.

The certification that had seemed so impressive—a GIA report documenting the diamond’s specifications—proved standard rather than special, with millions of diamonds carrying identical GIA certifications providing no differentiation or scarcity value. The lack of signed provenance from a prestigious house like Cartier or Van Cleef & Arpels meant the piece carried no brand premium that investment-grade jewelry commands through collector demand and auction house interest that generic retail jewelry never generates regardless of objective quality.

This forty-seven thousand dollar lesson transformed my understanding of jewelry from assumed investment to recognized consumption good that preserves some value through precious metal and gemstone content but rarely justifies calling purchases “investments” unless specific conditions align that typical retail buying never achieves. The experience initiated decade-long study of jewelry investment learning which pieces actually appreciate, where savvy buyers acquire inventory, how to avoid the retail markup trap, what characteristics distinguish investment-grade from consumer jewelry, and the strategies that sophisticated collectors employ to profit from jewelry purchases rather than suffering the fifty to seventy percent value destruction that standard retail buying produces.

The following comprehensive guide presents the accumulated knowledge from that painful education, revealing the truth about jewelry investment that the industry conceals while profiting from consumer ignorance. The goal involves enabling readers to distinguish genuinely appreciating jewelry from the value-destroying purchases that most people make, understanding where and how to acquire investment-grade pieces at prices allowing profit potential, recognizing the characteristics that drive long-term appreciation, and developing strategies for building jewelry holdings that preserve and grow wealth rather than evaporating value the moment you leave the store.

Different readers approach jewelry investment with different goals and constraints that require distinct strategies. True investors seeking maximum returns must completely ignore emotional appeal focusing purely on financial characteristics that drive appreciation regardless of whether pieces match personal taste or lifestyle. Collectors balancing aesthetic enjoyment with investment potential can accept lower financial returns in exchange for personal satisfaction wearing pieces they love while still avoiding the disastrous purchases that destroy wealth without compensation through beauty or craftsmanship. Wealth preservation buyers primarily concerned with protecting assets from inflation and currency devaluation require different selections than appreciation-focused investors aiming for substantial returns exceeding broader market indexes.

The investment approach detailed here assumes serious financial commitment with substantial capital allocated to jewelry holdings—the strategies work best for purchases exceeding ten thousand dollars where transaction costs and research time get justified by position size making profit realistic. Smaller purchases under five thousand dollars rarely justify the effort required for investment-grade selection and often get absorbed entirely by transaction costs leaving no profit potential regardless of piece appreciation. The guidance presumes access to capital, willingness to hold positions for years or decades waiting for appreciation to compound, comfort with illiquid assets that can’t quickly convert to cash during emergencies, and sophisticated understanding that jewelry investment requires specialized knowledge that most financial advisors and wealth managers completely lack.

Let’s examine exactly which jewelry pieces actually appreciate creating genuine investment opportunity, where smart buyers acquire those pieces at prices enabling profits rather than guaranteeing losses, how to authenticate and certify holdings protecting against fraud and misrepresentation, and the portfolio strategies that balance risk and return while avoiding the catastrophic mistakes that destroy wealth faster than appreciation can rebuild it.

The Brutal Truth About Jewelry as Investment Assets

The jewelry industry promotes the investment narrative aggressively because it provides powerful sales tool that transforms luxury purchases into supposedly prudent financial decisions rather than discretionary spending on depreciating assets. However, the investment reality proves far harsher than marketing materials suggest, with majority of jewelry purchases destroying substantial wealth through markups and poor selection that eliminate any chance of profitable resale regardless of how long pieces get held or how much underlying materials appreciate.

The Statistics Nobody Wants You to Know

Independent research tracking jewelry resale values demonstrates that seventy-three percent of retail jewelry purchases never recover their original cost when sold, with average resale proceeds reaching just forty-two percent of initial purchase price according to luxury asset analysis conducted by Knight Frank examining thousands of jewelry transactions across auction houses, dealers, and private sales. The grim statistics worsen for standard engagement rings and wedding jewelry where emotional premium gets paid at purchase but disappears entirely at resale when nobody values your particular love story enough to pay premium over raw material value.

The twenty-seven percent of jewelry purchases that do profit concentrate heavily in specific categories including signed pieces from prestigious houses, rare colored gemstones, exceptional quality diamonds above three carats, and antique jewelry with historical significance that mass-market retail stores never carry in inventory. The investment-grade jewelry that actually appreciates requires specialized knowledge to identify, access to wholesale or auction markets avoiding retail markup, and patience holding pieces for decades allowing appreciation to compound while bearing carrying costs that eat into returns reducing net profits below what simple statistics suggest.

The time value of money consideration makes jewelry investment performance even worse when properly analyzed using financial metrics that account for opportunity cost of capital deployed in jewelry rather than alternative investments. A piece purchased for fifty thousand dollars and sold twenty years later for seventy-five thousand dollars appears to generate fifty percent return and might get celebrated as successful investment, but the fifty thousand dollars invested in stock market indexes over same twenty year period would have grown to approximately one hundred sixty-five thousand dollars assuming historical seven percent annual returns, making the jewelry investment a massive opportunity cost failure despite nominal profit.

Comparing Jewelry Returns to Alternative Assets

The Knight Frank Luxury Investment Index tracking various passion assets including jewelry, watches, wine, art, and collectible cars demonstrates that jewelry produces median annual returns of three point four percent over past twenty years compared to seven point two percent for stocks, five point eight percent for fine art, and eight point six percent for classic cars. The underperformance might be acceptable if jewelry offered offsetting advantages like superior downside protection during market crashes, but jewelry actually exhibits high correlation with luxury goods spending that collapses during recessions when affluent buyers defer discretionary purchases, making jewelry poor diversifier offering minimal portfolio benefits beyond storage of tangible wealth during currency crises.

The jewelry performance statistics mask enormous variation between top-performing pieces and disastrous purchases, with the best investment jewelry generating fifteen to twenty-five percent annual returns rivaling or exceeding equity markets while the worst pieces lose fifty to seventy percent of value immediately and never recover despite decades of holding hoping for market conditions to improve. The performance distribution means that jewelry investment success depends almost entirely on initial selection and purchase price, with inability to identify and acquire the right pieces at right prices virtually guaranteeing poor returns that underperform simple index fund investment requiring zero specialized knowledge or active management.

Shop on AliExpress via link: wholesale-investment-grade-jewelry

Understanding Retail Markup: Why Most Jewelry Loses Value Immediately

The single largest factor destroying jewelry investment returns involves the retail markup structure that characterizes the jewelry industry where standard operating procedure involves marking up wholesale costs by two hundred to four hundred percent creating yawning gap between purchase price and resale value that appreciation must close before any profit becomes possible.

The Economics of Retail Jewelry Markup

A typical diamond engagement ring sold in upscale jewelry store for forty thousand dollars might cost the retailer twelve to fifteen thousand dollars for the diamond and setting at wholesale prices, representing two hundred sixty-seven to three hundred thirty-three percent markup that pays for expensive retail location, sales commission, marketing, insurance, and profit margin that shareholders demand for publicly traded jewelry chains. The markup far exceeds typical retail categories where thirty to one hundred percent markups prevail—clothing, electronics, and furniture rarely exceed doubling wholesale cost while jewelry routinely triples or quadruples it.

The enormous markup creates immediate value destruction where a customer paying forty thousand dollars for a ring receives asset worth perhaps fifteen to twenty thousand dollars in actual transaction value if sold immediately to wholesaler or auction house. The twenty to twenty-five thousand dollar loss happens instantly upon purchase before any holding period begins, creating massive hurdle that appreciation must overcome before breaking even becomes possible let alone generating actual profit. The typical three to four percent annual appreciation of standard jewelry means recovering that initial twenty-five thousand dollar deficit requires approximately fifteen to twenty years of holding assuming no carrying costs, essentially tying up substantial capital for decades just to break even on purchase.

The luxury houses including Cartier, Tiffany, Van Cleef & Arpels, and similar prestigious brands charge even higher markups ranging from four hundred to eight hundred percent over wholesale costs, justified by brand cachet and craftsmanship reputation but creating even more challenging investment scenarios despite the brand premium offering some resale value protection. A Cartier piece purchased for one hundred thousand dollars might have fifty to sixty thousand dollars of brand premium above the twenty to twenty-five thousand dollar material cost, with resale potentially recovering sixty to eighty thousand dollars to collectors valuing the Cartier signature—still representing twenty to forty thousand dollar loss but substantially better than generic jewelry that might fetch only twenty-five thousand dollars at resale because no brand premium exists.

Avoiding the Retail Markup Trap

The sophisticated jewelry investors who actually profit from holdings understand that retail stores represent the worst possible acquisition source because markup guarantees immediate substantial loss that makes profitable investment nearly impossible regardless of holding period or appreciation rates. The successful investors acquire inventory through alternative channels including auction houses where typical buyer premium of twenty-five percent still beats retail markup by enormous margin, estate sales where motivated sellers accept below-market prices needing quick liquidity, wholesale dealers who work with trade buyers but sometimes sell to qualified individuals, and private transactions with other collectors where no dealer intermediary extracts markup.

The auction acquisition strategy involves attending preview exhibitions examining pieces in person, researching comparable sales establishing realistic value ranges, setting strict bid limits based on investment analysis rather than emotional attachment, and accepting that winning bids often require patience attending multiple auctions before right opportunity at right price emerges. The auction buyers pay hammer price plus typical twenty-five percent buyer’s premium totaling one hundred twenty-five percent of winning bid, but this still represents massive discount versus three hundred to four hundred percent retail markup making auctions dramatically superior acquisition source for investment buyers despite some uncertainty about condition and authenticity requiring careful examination.

The estate sale opportunities require networking with estate attorneys, trust officers, and appraisers who handle high-value estates where heirs want quick liquidation and accept significant discounts for immediate cash rather than waiting for retail sale process requiring months or years. The estate buyers must move quickly when opportunities arise because best pieces get snapped up within hours of estate inventory becoming available to qualified buyers in the know, creating advantage for experienced investors with capital ready to deploy immediately when underpriced inventory surfaces.

Investment-Grade vs Consumer Jewelry: Critical Distinctions

The fundamental distinction separating investment jewelry from consumer purchases involves characteristics that create scarcity value, collector demand, and appreciation potential rather than merely satisfying personal aesthetic preferences or marking special occasions through purchase of pretty objects that lose most value immediately.

The Five Characteristics of Investment-Grade Jewelry

Investment-grade jewelry possesses five essential characteristics that consumer pieces typically lack: exceptional quality of materials graded at top levels of international standards, rarity through limited supply of particular stone types or sizes, provenance documentation from prestigious makers creating brand premium, timeless design that won’t date and lose appeal as fashions change, and strong historical auction results proving demand exists among serious collectors willing to pay premium prices.

The exceptional quality requirement means investment pieces must feature top-tier diamonds graded D-F color and IF-VVS clarity for colorless stones or fancy vivid color grades for rare colored diamonds, sapphires and rubies rated pigeon blood red or royal blue with minimal inclusions, emeralds graded vivid green with good clarity despite emerald’s typical inclusion issues, and precious metal content of eighteen or twenty-four karat gold rather than lower alloys. The quality standards exist because collectors and investors demand excellence and won’t pay investment premiums for mediocre stones regardless of other positive attributes the piece possesses.

The rarity component requires either naturally scarce materials like large high-quality colored diamonds occurring in only one per million stones, or artificially limited production like numbered Cartier series where only fifty pieces exist creating scarcity through intentional supply restriction. The rarity must be objective and verifiable rather than marketing claims about “rare” pieces that actually get mass-produced in thousands of examples with no genuine scarcity value. The natural scarcity generally proves more reliable than artificial because prestigious houses sometimes increase production of supposedly “limited” series when demand exceeds expectations, diluting scarcity value while natural material limitations can’t be overcome regardless of price.

The provenance documentation distinguishes signed pieces from famous houses or significant historical owners from generic jewelry lacking documented history. A Cartier necklace comes with original box, certificate, and records linking piece to specific production year and design series, creating authentication trail that supports value claims and attracts collectors specifically seeking Cartier inventory. The historical provenance—jewelry owned by celebrities, royalty, or connected to significant events—adds substantial premiums as collectors pay for story and connection to famous individuals beyond just material value.

Why Consumer Jewelry Fails Investment Tests

The typical jewelry that most people purchase from retail stores fails investment-grade tests on multiple dimensions making appreciation unlikely and profitable resale nearly impossible. The consumer pieces use good-enough quality rather than exceptional—SI1 clarity and H-I color diamonds that look fine to untrained eyes but don’t command collector premiums, standard gold alloys at fourteen karat rather than investment-preferred eighteen or twenty-four karat high purity, and synthetic or lower-quality gemstones that casual observers can’t distinguish from natural premium stones but that experts immediately identify reducing values dramatically.

In the gem and jewelry trade, pieces without documented maker or history receive commodity-level valuations based solely on current metal and gemstone market rates. A generic diamond ring typically appraises at twenty-five to forty percent of retail price, reflecting only wholesale value of the diamond and gold with no premiums added for design, craftsmanship, or maker—because the trade values anonymous pieces strictly by raw material content. The same diamond set in a Cartier mounting suddenly commands sixty to eighty percent of retail value and sometimes exceeds original purchase price for vintage pieces, purely through the brand and provenance premium that the gem trade recognizes for signed works from established houses

The fashion-driven designs that dominate consumer jewelry ensure pieces date and lose appeal as styles evolve, with yesterday’s trendy design becoming today’s dated look that buyers avoid regardless of quality or material value. The investment pieces maintain timeless classic designs that look appropriate in any era—simple solitaire diamond settings, classic tennis bracelets, elegant stud earrings, and refined designs that never scream particular decade or trend making them acceptable across generations of buyers.

Diamond Investment: The Colorless Trap vs Rare Colors

The diamond category presents the most complex investment analysis because consumer marketing emphasizes colorless diamonds while actual investment potential concentrates almost entirely in rare colored stones that most people never consider and that represent tiny fraction of total diamond market.

Why Standard Colorless Diamonds Fail as Investments

The colorless diamonds that dominate engagement ring purchases and represent ninety-eight percent of diamond jewelry sales prove terrible investments for several reasons that dealers conveniently neglect to mention while emphasizing diamond durability and eternal value. First, colorless diamonds exist in enormous quantity with millions of carats mined annually creating supply that meets or exceeds demand preventing scarcity premiums that drive appreciation. The De Beers monopoly that once controlled supply and artificially inflated prices collapsed decades ago with numerous producers flooding markets ensuring that standard diamonds trade as commodities with modest price fluctuations rather than substantial appreciation trends.

Second, the retail markup on colorless diamonds reaches three hundred to five hundred percent over wholesale prices creating impossible hurdle for profitable resale even if stones appreciate modestly over time. A one-carat D color IF clarity diamond might wholesale for six thousand dollars, retail for twenty-five thousand dollars, and resale for seven thousand dollars to a dealer or auction buyer—representing substantial loss despite stone being theoretically valuable and desirable. The markup trap means colorless diamond buyers can’t profit unless they acquire at wholesale prices that retail customers never access.

Third, synthetic diamonds created through CVD and HPHT processes have achieved quality levels matching natural stones at fraction of cost, creating supply competition that natural diamond prices must eventually accommodate through lower prices as consumers recognize that chemical composition matters less than artificial scarcity maintained through industry marketing. The synthetic competition primarily affects colorless diamonds where distinguishing natural from lab-grown requires expensive testing, while rare colored diamonds remain difficult to synthesize at quality levels matching natural stones maintaining premium pricing for natural colored diamonds.

Rare Colored Diamonds: Where Real Investment Potential Exists

The colored diamonds including pinks, blues, reds, greens, and fancy yellows represent less than two percent of diamonds mined annually with truly exceptional stones in vivid saturation levels appearing even more rarely creating genuine scarcity that drives substantial appreciation as wealthy collectors compete for limited supply. The Fancy Color Diamond Index tracking rare colored stone prices demonstrates fifteen to twenty-five percent annual appreciation over past two decades with pink diamonds from shuttered Argyle mine appreciating even faster at twenty-five to forty percent yearly as supply permanently contracted when mine closure eliminated the world’s primary pink diamond source.

The colored diamond investment requires sophisticated knowledge about color grading, with minor differences between “fancy intense” and “fancy vivid” grades creating fifty to one hundred percent price differentials that inexperienced buyers miss while overpaying for lesser grades. The ideal investment colored diamonds feature vivid saturation, even color distribution, sizes above one carat where scarcity intensifies, and GIA or similar certification documenting natural color rather than treatment that reduces values by eighty to ninety percent compared to natural color stones.

The pink diamonds offer best long-term appreciation potential through permanent supply constraints after Argyle mine closure, with existing pink diamonds representing essentially fixed supply while demand from Asian collectors particularly Chinese buyers continues growing creating scarcity crisis where prices must rise to clear limited available inventory. The investment-grade pinks require purplish-pink or pure pink hues avoiding brownish or orangish modifiers that reduce values, vivid saturation levels, and ideally over two carats where scarcity becomes extreme with only dozens of stones in that category sold annually worldwide.

Shop on AliExpress via link: wholesale-colored-diamond-jewelry

Gold Jewelry Investment: Karat Weight and Design Considerations

Gold jewelry presents more straightforward investment case than diamonds through transparent precious metal pricing, universal acceptance, and easy liquidation anywhere globally, but investment success still requires understanding karat purity impacts on value and avoiding design pitfalls that negate metal content advantages.

Karat Purity: The Higher the Better for Investment

The gold karat system indicates purity with twenty-four karat representing pure gold and lower karats indicating alloy content diluting gold with base metals—eighteen karat contains seventy-five percent gold and twenty-five percent alloy, fourteen karat contains fifty-eight percent gold, and ten karat contains only forty-two percent gold with majority base metal. The investment jewelry should emphasize twenty-two or twenty-four karat gold maximizing precious metal content and minimizing alloy that adds no value while reducing the percentage of purchase price represented by actual gold worth.

The Western jewelry tradition favors fourteen karat gold balancing durability with cost, but this represents poor investment choice because fifty-eight percent gold content means only half of jewelry weight contributes value while remainder consists of worthless copper, silver, or zinc alloy. The same ten thousand dollar purchase price buys approximately seventeen grams of gold content in fourteen karat piece versus twenty-five grams in twenty-four karat piece, with the additional eight grams of gold representing substantial difference in underlying value when gold trades above two thousand dollars per troy ounce.

The Asian jewelry markets particularly in India and Middle East emphasize twenty-two and twenty-four karat gold pieces that Western buyers sometimes dismiss as “too soft” for daily wear, but investment buyers should recognize that durability concerns matter less than gold content when purchase motivation involves wealth preservation rather than jewelry you’ll wear constantly. The higher purity gold maintains better resale value through higher precious metal percentage and cultural preferences in major gold markets where consumers pay premiums for purity rather than accepting fourteen karat compromises.

Design Impact on Gold Jewelry Investment Returns

The gold jewelry design dramatically affects investment returns beyond just metal content because intricate craftsmanship that adds cost at purchase often doesn’t translate to proportional resale value when buyers primarily value metal weight rather than artistic merit. A twenty-four karat gold chain with forty grams of gold content sells at slight premium over spot gold price perhaps fifteen to twenty-five percent markup for fabrication, while elaborate twenty-four karat necklace with same forty grams of gold but extensive handwork might cost three times spot gold price yet resell for only twenty to thirty percent over spot because buyers recognize they’re paying for gold by weight regardless of artistic merit.

The investment strategy should emphasize simple classic designs in high-karat gold where purchase price stays relatively close to gold content value ensuring that metal appreciation drives returns rather than hoping design premium gets recaptured at resale which rarely happens except for signed pieces from prestigious houses. The plain gold chains, simple bangles, classic wedding bands, and uncomplicated jewelry designs that boring from fashion perspective actually perform better as investments through maintaining tight relationship between purchase price and metal value that eliminates the design premium markup that never gets recovered.

The exception involves signed pieces from Cartier, Bulgari, Van Cleef & Arpels, and similar houses where design premium does get recognized at resale because collectors specifically seek pieces from those makers and will pay substantial premiums over metal content. A Cartier gold bracelet might contain five thousand dollars of gold at spot price but sell for fifteen to twenty thousand dollars reflecting brand premium, with resale potentially recovering twelve to eighteen thousand dollars maintaining seventy-five to ninety percent of purchase price even before any gold appreciation occurs. The branded premium makes luxury house gold jewelry better investment than equivalent quality generic pieces despite higher initial costs.

Platinum and Alternative Precious Metals

Platinum jewelry offers more precious metal content by weight than gold but suffers investment disadvantages through less universal recognition, narrower market, and more volatile pricing that makes liquidation challenging compared to gold’s established global infrastructure.

Platinum Investment Challenges

Platinum typically costs one point two to one point five times gold per troy ounce with prices fluctuating based on industrial demand particularly automotive catalytic converters creating commodity pricing volatility that investment jewelry should avoid. The platinum jewelry uses ninety to ninety-five percent purity compared to gold’s seventy-five percent in eighteen karat pieces, providing more precious metal content by weight, but the liquidation challenges and narrower market offset this advantage through difficulty finding buyers willing to pay fair prices when selling becomes necessary.

The platinum market concentration in Western developed economies means it lacks universal recognition that gold enjoys globally, with many cultures and countries showing limited interest in platinum jewelry preferring gold’s traditional status and easily recognized value. The geographic limitation creates liquidation challenges when selling platinum pieces requiring finding specialized buyers rather than accessing the universal gold market where countless dealers worldwide provide immediate liquidity at transparent pricing based on daily spot rates.

The investment verdict suggests avoiding platinum jewelry in favor of gold despite platinum’s superior metal content and rarity, unless acquiring signed pieces from prestigious houses where brand premium overcomes platinum’s marketing disadvantages. A Cartier platinum diamond ring might prove acceptable investment through Cartier signature adding sufficient premium that platinum limitations become irrelevant, while generic platinum jewelry presents unnecessary complications compared to equivalent gold pieces offering better liquidity and more predictable resale dynamics.

Colored Gemstones: Rubies, Sapphires, and Emeralds

The traditional “big three” colored gemstones—rubies, sapphires, and emeralds—offer investment potential when exceptional quality and proper certification document natural untreated stones commanding premium prices in collector markets.

Ruby Investment: Burmese Pigeon Blood Premium

Rubies represent the rarest and most valuable colored gemstone by weight with top-quality Burmese pigeon blood rubies above five carats selling for more per carat than equivalent diamonds creating substantial investment opportunity for stones meeting strict quality standards. The investment rubies require vivid red color without brown or orange modifiers, minimal inclusions despite ruby’s typical crystalline flaws, sizes above two carats where scarcity intensifies dramatically, and ideally Burmese origin that commands thirty to fifty percent premium over African or Thai rubies of equivalent quality.

The heat treatment that enhances ninety-eight percent of commercial rubies reduces investment value by fifty to eighty percent compared to untreated natural color stones, making treatment disclosure and certification absolutely essential for investment purchases. The untreated ruby certification from GubeLin or AGL laboratories provides necessary documentation that stones achieved their color naturally without heat or chemical treatment that compromises investment value despite creating visually equivalent appearance. The untreated requirement restricts investment ruby universe to tiny fraction of stones sold annually with perhaps two to three percent of rubies remaining untreated, creating genuine scarcity that drives appreciation as collectors compete for limited supply.

The Burmese ruby supply constraints through political instability and mine depletion mean that new material enters market sporadically with most investment-quality stones already in private collections or museums, creating supply-demand imbalance where prices must rise to clear the minimal inventory available for sale. The investment opportunity requires patience finding the right stone at right price through auction attendance, dealer relationships, and willingness to wait years for perfect opportunity rather than settling for good-enough stones that won’t appreciate.

Sapphire Investment: Kashmir and Ceylon Premiums

Sapphires offer broader investment opportunity than rubies through larger sizes available at comparable prices and less extreme scarcity creating more liquid market while still providing substantial appreciation potential. The investment sapphires emphasize royal blue color without purple or green modifiers, “velvety” appearance from fine silk inclusions that indicates unheated stones, sizes above five carats where serious collectors focus attention, and Kashmir or Ceylon origin commanding premiums over Australian or Thai sapphires despite potentially equivalent visual appearance.

The Kashmir sapphires from mines that closed decades ago represent the ultimate sapphire investment through legendary status among collectors, distinctive cornflower blue color with velvety texture, and permanent supply limitation ensuring perpetual scarcity. The Kashmir stones sell for five to ten times equivalent quality Ceylon sapphires purely through origin premium, with large Kashmir sapphires above ten carats achieving record auction prices exceeding one million dollars per carat at recent sales demonstrating extraordinary collector demand for these legendary stones.

The Ceylon sapphires provide more accessible investment opportunity through still-active mining producing world’s finest commercial sapphires at prices below Kashmir levels but above African alternatives. The investment-grade Ceylon sapphires require royal blue color, unheated or minimally heated treatment status, sizes above three carats ideally reaching five-plus carats, and clean clarity allowing light to penetrate without obstruction from excessive inclusions that reduce brilliance and value.

Emerald Investment: Colombian Vivid Green Standard

Emeralds present most challenging investment among big three colored stones through universal inclusion issues making clean stones extraordinarily rare, routine oiling treatment that requires disclosure but gets overlooked by some dealers, and relatively fragile nature requiring careful handling that makes jewelry setting risks higher than for harder rubies and sapphires. However, exceptional Colombian emeralds in vivid green color with good clarity command extraordinary prices and appreciate substantially as wealthy collectors seek finest examples of gem species prized since ancient times.

The investment emeralds require vivid saturated green color avoiding blue-green or yellow-green modifiers that reduce values, clarity levels of VS or better despite emerald’s typical inclusion issues making such clarity exceptional, Colombian origin commanding thirty to sixty percent premium over Zambian, Brazilian, or Afghan emeralds, and sizes above three carats where scarcity intensifies and collector interest peaks. The treatment status matters critically with untreated emeralds essentially unavailable in investment sizes while minor oiling treatment gets accepted as industry standard provided it’s properly disclosed, but more extensive filling or dyeing destroys investment value entirely.

The emerald fragility requires careful consideration of setting choices protecting stones from impact damage that could shatter them creating total loss, making insurance and proper storage absolutely essential for emerald investment positions. The emerald investment best suits collectors willing to vault stones in settings designed for protection rather than daily wear, or sophisticated buyers understanding the damage risks and willing to accept them in exchange for wearing truly exceptional gems.

Shop on AliExpress via link: wholesale-natural-ruby-sapphire

Rare Gemstones: Investment Potential of Alexandrite and Paraiba

Beyond the big three colored stones, certain rare gemstones offer exceptional investment potential through extreme scarcity, unique optical properties creating collector demand, and limited geographic sources that may exhaust ensuring permanent supply constraints.

Alexandrite: The Color-Change Investment Phenomenon

Alexandrite represents one of rarest gems with dramatic color-change from green in daylight to red under incandescent light creating optical phenomenon that no other gem duplicates at comparable quality levels. The investment alexandrites require strong color change showing distinct green and red rather than weak shifts between similar hues, sizes above two carats where alexandrite scarcity becomes extreme, Russian origin commanding premium over Brazilian stones, and certification documenting natural color-change rather than synthetic alexandrites that flood low-end markets.

The alexandrite appreciation accelerates as Russian supply largely exhausted with minimal new production meaning existing stones represent essentially fixed supply while collector awareness grows creating demand surge that prices must accommodate through increases. The five-carat quality alexandrites that sold for thirty to fifty thousand dollars in two thousand have reached one hundred fifty to three hundred thousand dollars currently representing three hundred to six hundred percent appreciation over twenty-year period and substantially outperforming stock market returns with less correlation to broader economy creating diversification benefits.

Paraiba Tourmaline: Neon Blue Scarcity

Paraiba tourmaline from Brazilian mine that quickly exhausted primary deposits represents one of newest “investment” gems developing collector following only over past three decades but achieving price appreciation rivaling established precious stones through extraordinary color, extreme scarcity, and growing recognition among sophisticated collectors. The investment Paraiba requires neon vivid blue color with copper content creating unique saturation that no other tourmaline achieves, sizes above two carats where scarcity intensifies dramatically, Brazilian origin commanding premium over African finds despite similar appearance, and clean clarity allowing neon color to display fully without inclusion interference.

The Paraiba prices surged from five hundred to two thousand dollars per carat in nineteen nineties to ten thousand to forty thousand dollars per carat currently for investment-grade stones above three carats, representing twenty to eighty times appreciation creating millionaire collectors who acquired position

s early. The supply constraints through mine depletion and limited African alternative sources suggest continued appreciation as wealth concentration in emerging markets creates new collectors seeking trophy gems that established wealthy already accumulated during earlier lower-price periods.

Signed Pieces: The Brand Premium That Actually Pays

The signature from prestigious jewelry house transforms identical quality materials into dramatically more valuable investment through brand recognition, provenance documentation, craftsmanship reputation, and collector demand creating secondary market where signatures command substantial premiums over unsigned equivalent pieces.

The Cartier Premium: Quantifying Brand Value

Cartier jewelry represents the gold standard for brand premium with pieces commanding two to five times value of equivalent unsigned jewelry depending on design, era, and model desirability. A simple Cartier love bracelet in eighteen karat gold containing approximately two thousand dollars of gold by weight retails for seven thousand five hundred dollars new and resells for five to six thousand dollars, while equivalent generic gold bangle might cost three thousand dollars new and resell for two thousand dollars. The Cartier signature adds three to four thousand dollars of brand premium that gets substantially recovered at resale unlike generic jewelry losing fifty to seventy percent of purchase price immediately.

The vintage Cartier pieces from nineteen twenties to nineteen sixties art deco and retro periods command even higher premiums through design excellence, historical significance, and finite supply of pieces from those legendary eras when house produced most iconic designs. The vintage Cartier panthere bracelet might contain five thousand dollars of gold and diamonds but sell for forty to sixty thousand dollars reflecting brand, design, and era premiums that collectors willingly pay, with resale potentially exceeding purchase price as appreciation continues for most desirable vintage pieces.

The investment strategy emphasizes acquiring Cartier at auction or estate sales avoiding retail markup while still securing authentic signed pieces with proper documentation. The auction Cartier pieces sell for thirty to seventy percent below retail creating immediate equity cushion before any appreciation occurs, with properly selected pieces potentially reselling at or above acquisition cost even short-term while offering long-term appreciation potential as vintage designs become increasingly scarce and collectible.

Van Cleef & Arpels: Technical Excellence Premium

Van Cleef & Arpels commands premium through technical innovation including mystery set gemstones technique and serti neige diamond settings creating distinctive appearance that collectors recognize and value. The investment-grade Van Cleef emphasizes pieces using signature techniques rather than simple designs that could come from any house, vintage pieces from nineteen forties to nineteen seventies when craftsmanship peaked, and jewels from famous collections including Duchess of Windsor pieces that achieved record auction prices through combined VCA signature and celebrity provenance.

The VCA Alhambra collection represents accessible entry point providing authentic VCA signature at relatively modest thirty-five hundred to ten thousand dollar price points for necklaces and bracelets, with vintage Alhambra pieces from seventies and eighties when collection launched selling at premiums reflecting both VCA signature and collectible vintage status. The simple clover motif Alhambra designs maintain timeless appeal avoiding fashion risks while providing authentic VCA signature and potential appreciation as collection recognition grows.

Vintage and Antique Jewelry: Age as Value Driver

The vintage and antique jewelry market rewards age through scarcity of surviving pieces, historical significance, superior craftsmanship from pre-mass-production eras, and collector demand for jewelry representing specific artistic periods with distinct design characteristics that contemporary pieces don’t replicate.

Art Deco Investment Premium

Art deco jewelry from nineteen twenties and nineteen thirties commands substantial premiums through geometric designs reflecting period aesthetics, platinum and diamond emphasis creating luxurious appearance, superior craftsmanship before mass production, and scarcity as surviving pieces get accumulated by collectors and museums reducing available supply. The investment-grade art deco jewelry requires authentic period pieces rather than later reproductions, documented provenance ideally including original house attribution, excellent condition despite age, and designs exemplifying deco geometric aesthetic rather than transitional pieces showing mixed period influence.

The art deco diamond bracelets represent particularly strong investment through dramatic appearance, wearability for modern collectors, and prices that remain below contemporaneous art deco architecture and decorative arts creating relative value opportunity. The thirty to eighty thousand dollar range captures exceptional art deco bracelets that worn to gala events provide both aesthetic enjoyment and investment value, beating practical returns from equivalent money in stock portfolios while offering tangible beauty and usability that financial securities never provide.

Auction vs Retail: Where Smart Investors Buy

The acquisition source determines investment success more than any other single factor through price differential between retail markup and wholesale-adjacent auction pricing creating profit potential before any appreciation occurs versus guaranteed loss from retail purchases that never recover initial markup.

Major Auction Houses: Christie's, Sotheby's, and Bonhams

The international auction houses including Christie’s and Sotheby’s conduct magnificent jewelry sales twice yearly in New York, Geneva, and Hong Kong where investment-grade pieces concentrate offering buyers access to finest jewelry at prices substantially below retail despite buyer’s premium adding twenty-five percent to hammer price. The auction catalog previews allow examination of pieces weeks before sale with experts available answering questions about condition, provenance, and quality characteristics that determine value.

The auction strategy requires researching comparable sales establishing value ranges for targeted pieces, setting strict maximum bids based on investment analysis including estimated resale value and required appreciation rates achieving target returns, attending multiple sales developing market knowledge and relationships with specialists, and accepting that winning bids demands patience often losing multiple auctions before securing the right piece at right price. The auction premium of twenty-five percent on hammer price still beats retail markup of two hundred to four hundred percent by enormous margin making auctions dramatically superior acquisition source despite premium costs.

The auction timing matters with best buying opportunities occurring during economic downturns when luxury spending contracts reducing demand and allowing patient buyers to acquire quality pieces at below-trend prices that rebound when economic conditions improve. The two thousand eight financial crisis created extraordinary auction opportunities with jewelry prices falling thirty to fifty percent from two thousand seven peaks before recovering and eventually exceeding previous highs creating substantial profits for buyers with capital and courage to purchase during maximum pessimism.

Estate Sales and Private Transactions

Estate sales represent another excellent acquisition source where motivated sellers accept below-market prices for quick liquidation to settle estates, with professional estate sale companies and attorneys handling valuable jewelry often lacking specialized gemological knowledge allowing savvy buyers to identify underpriced pieces that company missed. The estate sale attendance requires monitoring local listings, arriving early before best pieces get claimed, bringing gemological equipment for on-site evaluation, and having capital ready for immediate purchase before other buyers recognize opportunities.

The private collector transactions offer potential for negotiated purchases where both parties benefit through eliminating dealer intermediary who would extract markup buying from seller and selling to buyer. The private market access requires networking within collector community through auction attendance, jewelry organization membership, and dealer relationships where you become known as serious buyer willing to pay fair prices for quality pieces. The private transactions work best for established collectors with reputations for honest dealing and proper payment rather than newcomers unknown in the market who sellers view skeptically.

Authentication and Certification: Protecting Your Investment

The authentication and certification documentation proves essential for establishing value, preventing fraud, facilitating resale, and providing insurance documentation supporting claims if theft or loss occurs. The proper certification costs represent small percentage of total investment but provides enormous value through fraud protection and enhanced resale prospects.

Laboratory Certification: GIA, AGL, and GubeLin Standards

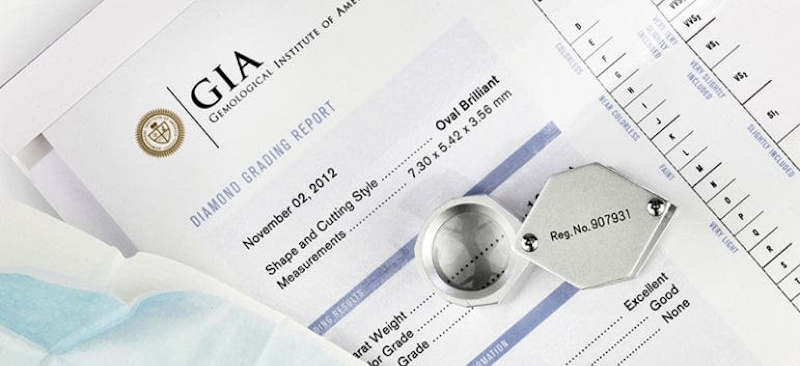

The Gemological Institute of America represents the international standard for diamond grading with GIA certificates providing detailed documentation of carat weight, color grade, clarity assessment, cut quality, and treatment disclosure that buyers worldwide recognize and trust. The investment diamonds should always carry GIA certification rather than unknown laboratories that might inflate grades to make inferior stones appear more valuable, with certificate number verifiable on GIA website confirming authenticity and matching physical stone through laser inscription on diamond girdle.

The American Gemological Laboratories and Swiss GubeLin laboratory provide authoritative colored gemstone certification documenting natural origin, treatment status, and geographic source when determinable through inclusion analysis and chemical composition. The AGL and GubeLin reports carry premium value for investment rubies, sapphires, and emeralds through reputations for conservative grading and reliable treatment disclosure that buyers trust implicitly. The certification costs of three hundred to eight hundred dollars per stone represent trivial expense for investment pieces worth tens or hundreds of thousands of dollars while providing documentation essential for authentication and resale.

The signed jewelry from Cartier, Van Cleef & Arpels, and similar houses should include original boxes, certificates, and receipts documenting authenticity and purchase history. The complete documentation package substantially enhances resale value through eliminating authentication uncertainty that makes buyers hesitant about unsigned or poorly documented pieces regardless of apparent quality. The documentation preservation requires secure storage preventing loss or damage that could complicate future sales when buyers demand proof of authenticity before paying premium prices.

Appraisal for Insurance and Valuation

Independent appraisals from certified gemologists provide insurance documentation and periodic valuation tracking piece appreciation or depreciation over holding periods. The appraisal should come from independent appraiser with no purchase interest avoiding conflict where appraiser inflates values encouraging sales or insurance upselling, with fees charged hourly or per piece rather than percentage of appraised value that creates incentive for inflated assessments.

The insurance appraisals typically reflect replacement cost at retail rather than actual market value creating inflated figures that help with insurance coverage but don’t represent realistic resale expectations. The investment tracking requires separate market value appraisals assessing what pieces would actually sell for at auction or through dealers, with these realistic valuations often running thirty to sixty percent below insurance replacement cost appraisals. The periodic reappraisal every three to five years tracks value changes, ensures adequate insurance coverage, and provides data for investment performance monitoring over time.

Insurance, Storage, and Carrying Costs

The jewelry investment carrying costs including insurance premiums, secure storage, and periodic maintenance reduce net returns requiring careful management to avoid expense drag that consumes appreciation and destroys overall profitability despite piece value increases.

Insurance Costs and Coverage Options

Comprehensive jewelry insurance protecting against theft, loss, damage, and mysterious disappearance costs approximately one to two percent of appraised value annually depending on storage location, security measures, and coverage details. A one hundred thousand dollar jewelry collection requires one thousand to two thousand dollar annual insurance premiums representing meaningful expense that compounds over decades of holding reducing net returns by ten to twenty percent of total appreciation assuming seven to ten percent average annual value growth.

The insurance options include scheduled personal property endorsements on homeowner policies covering jewelry up to certain limits typically twenty-five to fifty thousand dollars before requiring separate scheduled items, standalone jewelry insurance policies providing comprehensive coverage without dollar limits, and blanket coverage for entire collections rather than scheduling individual pieces. The scheduled items require individual appraisals and documentation while blanket coverage allows flexibility adding and removing pieces without policy amendments but typically costs slightly more through premium calculation on total coverage amount.

The insurance strategy balances adequate protection against excessive premium costs through evaluating actual risk exposure, deductible selection reducing premiums at cost of bearing small losses personally, and vault storage at security facilities reducing theft risk allowing lower premiums versus home storage creating higher risk and correspondingly higher insurance costs. The optimal approach varies by collection size with smaller holdings under fifty thousand dollars possibly self-insuring through emergency fund coverage while larger collections require professional insurance despite expense because total loss would devastate financial position.

Storage Solutions and Security Considerations

Secure storage options include bank safety deposit boxes costing two hundred to six hundred dollars annually for adequate size, home safes requiring one thousand to five thousand dollar initial investment plus installation costs, and professional vault storage at specialized facilities offering insurance discounts through enhanced security. The storage choice depends on collection size, wearing frequency requiring regular access, and risk tolerance balancing convenience against security and insurance cost implications.

The bank safety deposit boxes provide excellent security at reasonable cost but limit access to banking hours creating inconvenience when spontaneous wearing decisions arise. The home safes offer convenient access but require proper installation, adequate fire rating protecting against heat damage, and sufficient security rating preventing forced entry that could compromise entire collection. The professional vault storage offers maximum security and insurance benefits but costs substantially more while making casual wearing essentially impossible through access restrictions and retrieval delays.

The storage strategy should match collection purpose with investment holdings intended for long-term appreciation stored securely in bank vaults or professional facilities minimizing insurance costs, while jewelry intended for regular wearing kept in home safes accepting slightly higher insurance premiums in exchange for convenient access. The divided storage approach allocates pieces by function rather than storing everything identically regardless of use patterns and risk profiles.

Shop on AliExpress via link: wholesale-jewelry-safe-storage

Tax Implications of Jewelry Investment

The jewelry investment tax treatment involves capital gains on profitable sales, potential collectibles tax rates higher than standard investment assets, estate tax considerations, and reporting requirements that investors must understand for proper tax planning and compliance.

Capital Gains Tax on Jewelry Sales

Jewelry held over one year and sold at profit generates long-term capital gain taxed at collectibles rate of twenty-eight percent maximum for high earners rather than fifteen or twenty percent maximum applying to stocks and bonds, creating tax disadvantage that reduces after-tax returns by meaningful amounts. A jewelry piece purchased for fifty thousand dollars and sold for one hundred thousand dollars generates fifty thousand dollar gain taxed at twenty-eight percent creating fourteen thousand dollar tax liability leaving thirty-six thousand net profit representing seventy-two percent after-tax return versus eighty percent if regular capital gains rates applied.

The tax treatment disadvantage makes jewelry less attractive than comparable-return financial investments from pure after-tax perspective, though the non-correlation benefits and inflation protection might justify allocation despite higher tax costs. The tax-deferred strategies including charitable remainder trusts or opportunity zone investments might offer approaches for minimizing tax drag on jewelry gains but require sophisticated planning and often only make sense for large positions worth hundreds of thousands where tax savings justify complex structure costs.

The cost basis tracking requires maintaining documentation of original purchase price, subsequent improvements like resetting or repair costs that increase basis, and transaction fees at purchase and sale that reduce taxable gain. The inadequate record-keeping creates problems at sale when IRS requires basis documentation supporting gain calculations, potentially resulting in entire sale price treated as gain if taxpayer can’t prove what was originally paid creating massive unexpected tax liability.

Estate Planning and Gift Tax Considerations

Jewelry passing to heirs at death receives stepped-up basis to fair market value at death date eliminating capital gains tax on appreciation during decedent’s lifetime creating tax advantage for holding jewelry until death rather than selling and paying gains tax. The estate inclusion means jewelry value counts toward estate tax exemption currently eleven point seven million per person but subject to future reduction depending on political changes, with taxable estates paying forty percent on amounts exceeding exemption including jewelry value.

The lifetime gifting of jewelry to family members uses annual gift tax exclusion currently seventeen thousand dollars per recipient per year allowing gradual transfer of collection without gift tax consequences, though basis transfers at carryover rather than stepped-up creating potential capital gains tax for recipients when they eventually sell. The gifting strategy works best for jewelry unlikely to appreciate substantially where future gains will be minimal versus highly appreciating pieces better held until death for stepped-up basis benefit.

Market Timing: When to Buy and Sell

The jewelry market exhibits cyclical patterns with optimal buying periods during economic downturns when luxury spending contracts and selling opportunities when strong economies create peak demand and maximum prices, though timing markets perfectly proves impossible making disciplined buying and patient selling more important than attempting precise market calls.

Economic Cycle Impact on Jewelry Prices

Luxury jewelry prices demonstrate strong correlation with stock markets and economic conditions through wealth effects where rising stock portfolios and strong economies encourage discretionary luxury spending while market crashes and recessions cause wealthy buyers deferring non-essential purchases. The two thousand eight financial crisis saw jewelry auction prices fall thirty to fifty percent from two thousand seven peaks as credit crisis eliminated buyers and forced selling from distressed estates and collections, creating extraordinary buying opportunities for investors with capital and courage to purchase during maximum pessimism.

The recovery from two thousand nine through two thousand nineteen saw jewelry prices surge seventy to one hundred fifty percent depending on category as returning confidence and wealth creation from market recovery drove luxury spending to new highs. The pattern suggests buying during recessions and financial crises when prices fall despite underlying quality unchanged and selling during late-cycle periods when exuberant spending drives prices to unsustainable levels likely to correct in next downturn.

The dollar-cost averaging approach where investors make consistent purchases over time regardless of conditions provides alternative to market timing through averaging in at various price points rather than attempting perfect entry timing that requires impossible predictive ability. The systematic buying every year or quarter over decades builds position while avoiding risk of investing entire portfolio at market peak before major correction.

Optimal Selling Windows

The ideal selling periods occur during strong economic conditions when wealthy buyers actively seek jewelry, major auction houses conduct prestigious sales attracting international bidders, and specific categories experience temporary demand surges from fashion trends or celebrity influence. The pink diamond surge following Argyle mine closure announcement created optimal selling window for existing pink diamond owners to capture maximum prices from buyers anticipating permanent supply reduction, with prices unlikely to retreat even if demand moderates because supply really did permanently contract.

The tax considerations affect selling timing with year-end sales potentially deferred to January avoiding current year tax liability while early-year sales allow deferring tax payment until following April providing time value benefit. The estate planning situations where heirs inherit jewelry and want immediate liquidity often create selling pressure accepting below-optimal prices rather than waiting for better market conditions, creating buying opportunities for patient investors willing to purchase from motivated sellers.

Building a Jewelry Investment Portfolio

The jewelry investment portfolio construction requires diversification across categories, quality levels, and acquisition time periods while maintaining focus on investment-grade pieces rather than diluting returns through non-investment jewelry lacking appreciation potential.

Diversification Strategy

The diversified jewelry portfolio allocates capital across diamonds including rare colored and exceptional colorless stones, colored gemstones emphasizing big three rubies-sapphires-emeralds plus rare varieties, precious metal jewelry focusing on high-karat gold pieces, and signed pieces from prestigious houses providing brand premium protection. The allocation percentages depend on individual preferences and market views but might include forty percent diamonds, thirty percent colored gemstones, twenty percent gold jewelry, and ten percent signed pieces without gemstone emphasis.

The quality focus maintains investment-grade standards across all categories rather than mixing investment pieces with consumer jewelry that drags down overall returns through poor performers canceling gains from winners. The portfolio discipline requires rejecting good-enough pieces waiting for truly investment-grade opportunities rather than buying anything available just to deploy capital, with patience being essential virtue that separates successful investors from those who accumulate mixed-quality collections yielding mediocre returns.

The temporal diversification through acquiring pieces gradually over years or decades rather than investing entire allocation immediately provides price averaging benefits while allowing expertise development through experience and learning that improves later purchase decisions. The ten to twenty year portfolio building period creates multiple buying opportunities at various market conditions rather than concentrating risk in single entry point that might unfortunately coincide with market peak.

Exit Strategies: Maximizing Resale Value

The jewelry investment exit requires careful planning to maximize sale proceeds through optimal venue selection, timing decisions, presentation quality, and negotiation approaches that vary by piece value and urgency for liquidation.

Auction Consignment Strategy

Major auction houses provide optimal exit for investment-grade jewelry through international buyer reach, professional marketing and cataloging, expert lot grouping creating buying momentum, and transparent public price discovery establishing fair market value. The auction consignment requires minimum values typically ten thousand dollars per piece with higher minimums of fifty thousand or more for prestigious evening sales versus day sales accepting lower-value lots.

The consignment process begins six to nine months before sale with auction house specialist reviewing pieces, estimating values and establishing reserve prices below which piece won’t sell, photographing and cataloging for auction marketing, and scheduling for appropriate sale date and venue. The reserve setting proves critical with too-high reserves causing pieces to pass without selling while too-low reserves risk selling below fair value, requiring realistic expectations based on comparable sales and current market conditions.

The auction costs include seller’s commission typically ten to twenty percent of hammer price with higher-value lots negotiating lower rates, insurance and cataloging fees, and opportunity cost of waiting six to nine months for sale when immediate liquidity might be preferred. The net proceeds after commissions and fees typically reach seventy-five to eighty-five percent of hammer price, still substantially better than dealer offers buying at wholesale leaving thirty to fifty percent margins.

Private Sale Alternatives

Private sales to other collectors, dealers, or through auction house private treaty departments offer faster liquidity than public auctions while potentially achieving better net proceeds through eliminating or reducing buyer’s premium and seller’s commission that public auction charges. The private sales work best for unique high-value pieces where small number of serious buyers exist making public auction unnecessary, or when discretion matters avoiding public disclosure of selling activity.

The dealer sales provide immediate liquidity but worst prices typically recovering only thirty to fifty percent of retail value reflecting dealer’s need to resell at profit after buying inventory. The dealer option makes sense only for small liquidations under five thousand dollars where auction minimums aren’t met or when immediate cash needs override maximizing sale proceeds with no time for multi-month auction process.

Common Mistakes That Destroy Returns

The jewelry investment failures concentrate in predictable mistakes that destroy returns through overpaying at acquisition, choosing wrong pieces lacking appreciation potential, neglecting documentation and authentication, and selling prematurely or during unfavorable market conditions.

The Retail Purchase Trap

Buying jewelry from retail stores represents the single worst investment mistake ensuring immediate fifty to seventy percent value loss that appreciation rarely overcomes during reasonable holding periods. The retail markup of two hundred to four hundred percent means a forty thousand dollar retail purchase provides perhaps twelve to fifteen thousand dollars of actual value if sold immediately, requiring decades of appreciation just recovering initial deficit before any profit becomes possible. The sophisticated investors understand retail stores serve consumers buying jewelry for personal use accepting value loss as cost of romantic gesture or aesthetic enjoyment, never serving investment buyers who must avoid retail entirely focusing exclusively on wholesale-adjacent acquisition through auctions, estates, and private sales.

The retail trap catches buyers who believe that prestigious retail location, impressive showroom, confident sales pitches, and beautiful presentation indicate investment quality when these factors actually represent expensive overhead requiring massive markup to fund luxury retail experience. The mall jewelry stores and even upscale Fifth Avenue boutiques charge identical absurd markups selling commodity diamonds and gold at triple or quadruple wholesale while implying that high retail price indicates exceptional value justifying premium investment when opposite proves true.

Choosing Non-Investment Pieces

The second costliest mistake involves selecting jewelry lacking investment-grade characteristics including standard commercial-quality diamonds and gemstones without rarity premium, low-karat gold with minimal precious metal content, unsigned pieces without brand premium, and trendy designs that date quickly losing appeal to future buyers. The consumer-grade jewelry might look attractive and serve perfectly well for personal wearing but carries no investment potential regardless of holding period or market conditions.

The diamond example proves illustrative where standard one-carat G color SI1 clarity diamonds sell for eight to twelve thousand dollars retail representing commodity stones produced in tens of thousands annually with no scarcity creating appreciation pressure. The same twelve thousand dollars invested in rare half-carat fancy vivid pink diamond buys genuinely scarce stone appearing perhaps once in fifty thousand diamonds mined, creating scarcity that drives fifteen to twenty-five percent annual appreciation over past decades. The investment success depends entirely on choosing right categories and quality levels rather than assuming any expensive jewelry qualifies as investment worthy of capital allocation.

Documentation and Authentication Failures

The inadequate documentation and certification creates problems at resale when buyers demand proof of authenticity, treatment disclosure, and provenance before paying investment prices for pieces lacking proper papers. The GIA certification costs three hundred to six hundred dollars but provides enormous value through authentication and quality verification that buyers require before paying premium prices, yet many investors skip certification trying to save trivial amounts while risking substantial discounts or complete inability to sell pieces when buyers won’t proceed without proper documentation.

The provenance documentation proves especially critical for signed pieces where original boxes, certificates, and receipts from Cartier or Van Cleef & Arpels substantiate authenticity and manufacture date establishing vintage status that commands premium prices. The missing documentation raises authenticity questions that buyers resolve by offering lower prices reflecting uncertainty, or by walking away entirely rather than risking large sums on potentially counterfeit pieces regardless of apparent quality.

Conclusion: Strategic Approach to Jewelry Investment

Jewelry investment offers wealth preservation opportunity and potential appreciation for sophisticated buyers willing to develop specialized knowledge, access wholesale-adjacent acquisition channels, maintain strict quality standards focusing on truly investment-grade pieces, and exercise patience holding positions for years or decades allowing compound appreciation while bearing carrying costs that reduce net returns. The category definitely works as investment for those approaching it properly with realistic expectations, adequate capital justifying transaction costs and carrying expenses, and commitment to learning what distinguishes investment jewelry from consumer purchases that destroy wealth despite impressive appearance and high retail prices.

However, jewelry categorically fails as investment for casual buyers making retail purchases, selecting pieces based on aesthetic appeal rather than investment characteristics, expecting short-term profits that rarely materialize, or lacking capital making five-figure minimum investments necessary for accessing investment-grade pieces and auction acquisition channels. The retail jewelry serves personal enjoyment and relationship commemoration purposes perfectly well despite terrible investment economics, but calling such purchases investments rather than consumption spending reflects dangerous confusion that costs buyers substantial wealth through misallocating capital that simple stock index funds would grow more reliably.